- Summary:

- Bitcoin prices have experienced a sharp drop following comments by President Trump. Read our update to find out what may happen next.

After hitting its highest price in 18 months, Bitcoin plunged to $9,840 after President Donald Trump signaled his dislike for Bitcoin and cryptos in general. President Trump’s comments mirrors the concerns of governments and regulators as they renew their searchlight on cryptocurrencies following Facebook’s Libra announcement. Last week, Fed Chief Powell indicated in his testimony before the US Congress that there was going to be some sort of discussion about Libra at the G7 Finance Ministers meeting in France this week.

Bitcoin has gained more than 400% in the last three months on renewed optimism, but the negative perception it continues to receive from the regulatory end of the market chain may cause bulls to reconsider their positions.

BTC/USD has opened the week with a modest gain and is trading at $10,600 as at the time of writing.

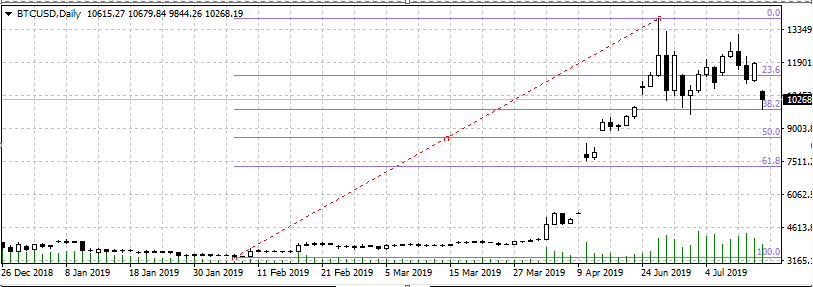

BTC/USD bounced at the 38.2% Fibonacci retracement, on a trace from the February 2019 swing lows to last week’s swing highs. This was a price level where support was also found in June 2019. Further bullishness will see price test the 23.6% Fibonacci level of $11,310. A re-test and subsequent break of the present support levels will open the door for price to target the 50% retracement level at $8,435.

Further price direction may come from crypto-related statements out of the G7 Finance ministers meeting later this week, so crypto traders must exercise vigilance when setting up positions.

BTC/USD Daily Chart

Don’t miss a beat! Follow us on Twitter.

Download our Q3 market outlook today for our longer-term outlook for the markets and trade ideas.