- Summary:

- The BT share price has started the year well. The stock is trading at 180p, which is the highest it has been since July last year.

The BT share price has started the year well. The stock is trading at 180p, which is the highest it has been since July last year. It has jumped by over 34% from its lowest level in October.

BT Group has been in the spotlight since Patrick Drahi, the French billionaire acquired a stake. He added a stake in December, which makes him the biggest investor in the company.

The BT share price jumped on Thursday after it became clearer that the firm is selling its BT Sport brand. According to Reuters, the company is planning to sell the brand to media startup DAZN for about $800 million. DAZN is a small media streaming company backed by billionaire Len Blavatnic. By acquiring BT Sport, he will get rights to the European Premier League (EPL) and Champions League.

The BT stock rose partly because analysts expect that there could be a bidding war since Discovery is said to be interested in the business. Still, BT will be the beneficiary because the deal will help it pay a special dividend and boost its cash reserves. Most importantly, it will be at a good position to focus on its OpenReach business.

BT share price forecast

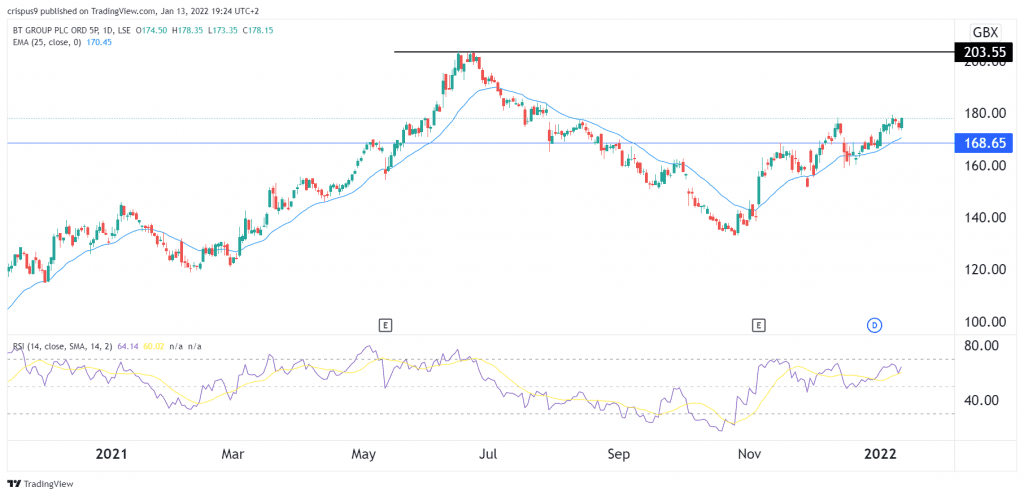

The daily chart shows that the BT stock price has been in a bullish trend in the past few weeks. And this week, the stock reached the key resistance level at 180p, which was the highest level in December. The stock is above the 25-day and 50-day exponential moving averages (EMA). Oscillators like the MACD and the Relative Strength Index (RSI) have also kept rising.

Therefore, as I wrote recently, the path of the least resistance for the BT share price us upwards. The next key resistance to watch will be at 200p. This view will be invalidated if the stock falls below 170p.