- Summary:

- BT share price slumped to the lowest level since November 2021 as worries about the company’s growth and earnings remain.

BT share price slumped to the lowest level since November 2021 as worries about the company’s growth and earnings remain. The shares collapsed to a low of 152.70p, which was about 25% below the highest level this year.

BT faces margin pressure.

BT Group is a leading telecommunication company that provides several important services in the UK and several other European countries. Some of its top products are Openreach, voice, and media. Its media business made a joint venture with Warner Bros early this year.

The BT share price has lagged recently as investors focus on the company’s slowing growth. However, with inflation rising, analysts expect that some of its divisions will continue struggling.

At the same time, investors are concerned about the company’s margins as workers demand higher pay. In addition, thousands of the company’s staff will hold a strike on Tuesday to pressure management to add their pay in a bid to cover their living expenses. Therefore, all these factors will likely lead to thin margins.

Earlier this week, BT Group announced that UK’s regulators had stopped conducting a security review on Patrick Drahi. The French billionaire became the biggest shareholder in the company through his Altice business. Some analysts believe that he could mount a bid for the entire company in the coming years.

Meanwhile, some analysts and models believe BT stock price is cheap. For example, a DCF calculation shows that the company is trading at 50.7% below the fair value.

BT share price forecast

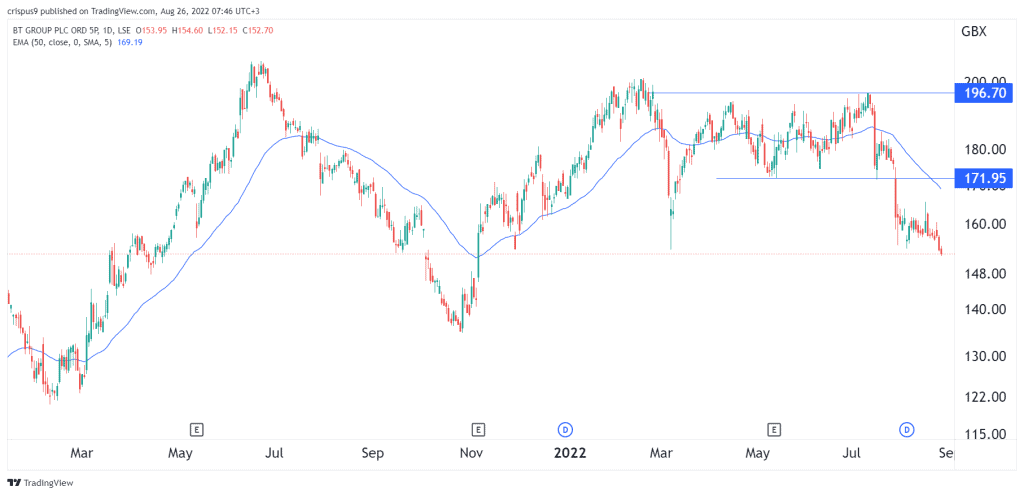

The daily chart shows that the BT Group share price formed a triple-top pattern at 196.70p early this year. It then dropped below the neckline at 171.95p. This week, it managed to move below the important support at 153.90p, which was the lowest level on March 4. In addition, it has crashed below the 25-day and 50-day moving averages.

Therefore, the BT share price outlook is extremely bearish, with the next key support being at 140p. However, a move above the resistance at 160p will invalidate the bearish view.