- The BT share price will be in the spotlight on Monday as the market reflect on the intrigues surrounding the company’s sports business.

The BT share price will be in the spotlight on Monday as the market reflect on the intrigues surrounding the company’s sports business. The stock ended last week at 168p, which was about 25% above the lowest level in October.

There will be two key catalysts for the BT stock price this week. First, it was reported during the weekend that Discovery was interested in BT Sport. This is a service that broadcasts top matches like the English Premier League and Champions League.

According to the Financial Times, Discovery has offered to create a joint venture with BT Group. The paper reported that BT executives were taking the offer more seriously. If the deal goes on, it will be a disappointing end for DAZN, the company that had expressed interest in the service. This is notable since DAZN is still an unprofitable startup.

The other key catalyst for the BT share price is that Patrick Drahi has a few days left to declare. It was reported that he was eying a board seat if he manages to buy a stake from Deutsche Telekom. Still, an outright purchase of the company could be challenged by the UK government because of the company’s strategic importance.

BT share price forecast

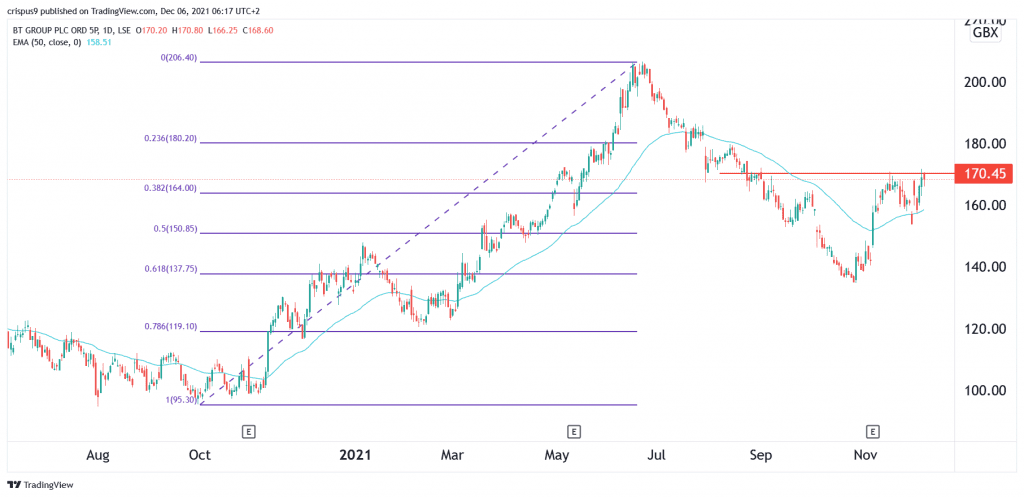

The daily chart shows that the BT share price has been rising slowly in the past few weeks. During this period, the stock has managed to move from the 61.8% Fibonacci retracement level to above the 38.2% level. It has also formed a small inverted head and shoulders pattern. At the same time, the stock has moved above the 25-day and 50-day moving averages.

Therefore, there is a likelihood that the BT stock price will have a bullish breakout this week. If this happens, the next key level to watch will be at the 23.6% retracement level at 180p. On the flip side, a move below 160p will invalidate this view.