- Summary:

- The British Pound is trading lower in early Monday session trading, as renewed fears of a no-deal Brexit have resurfaced.

The British Pound is trading lower today against the US Dollar and the Euro as fears of a no-deal Brexit have resurfaced. This is after the sudden resignation of the UK Foreign Minister Sir Alan Duncan. In a Twitter letter, Sir Duncan opined that the UK was being compelled to operate under a Brexit-induced “dark cloud”, despite the potential of the UK having the potential of being the “dominant intellectual and political force throughout Europe, and beyond” he was quoted as saying in a Reuters news report.

There are fears that as the new UK Prime Minister is announced tomorrow, more ministers could resign in the coming hours. Former London mayor and staunch Brexit proponent Boris Johnson is tipped to succeed Theresa May as UK Prime Minister.

This Week’s Outlook for the British Pound

Politics will dominate the outlook for the British Pound this week. There are rising odds of a ‘no deal’ Brexit scenario, and poor economic fundamentals continue to pressurize the Cable. This may force the Bank of England’s hand, and markets are already starting to factor in a possible rate cut before the year runs out.

British Pound’s Technical Plays

GBP/USD Key Levels

The British Pound has just broken the S1 daily pivot support at 1.24686 in its pairing with the US Dollar. Price is presently experiencing a pullback. If the S1 (now a resistance) is able to resist the pullback, GBPUSD could test 1.24321 intraday. Further downside violation of this level will open the door for a run to 1.2388. To the upside, recovery beyond 1.24686 will see GBPUSD target immediate resistance at 1.25125. Sentiment remains bearish.

EUR/GBP key levels

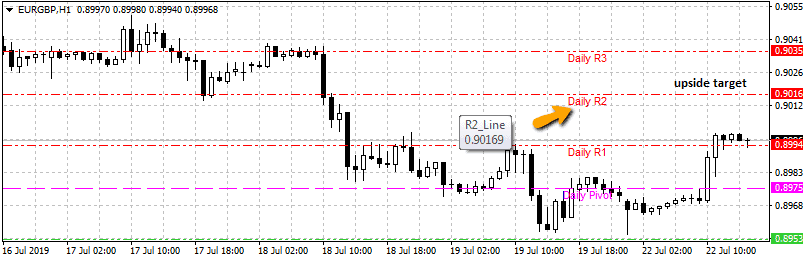

EUR/GBP has broken the R1 pivot at 0.89948. Further upside targets lie at 0.90169 and 0.90359. Recovery of price to levels below 0.89948 will see the 0.8975 and possibly 0.8953 areas being targeted. Sentiment is however bullish, but this will depend on key economic data being released this week for the Euro, including the ECB’s rate decision and accompanying statement.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.