- Brent crude oil price predictions may turn bearish as cooling demand from China cancels out supply disruptions and lower US reserves.

Bullish Brent crude oil price predictions received a boost on Thursday after the main oil benchmark added 0.47% on the day. This uptick comes after the Energy Information Administration reported a US crude oil inventory shortfall on Wednesday.

US crude oil stocks fell by 8.0m barrels, way below the excess of 9.4m seen in the previous week and lower than analysts’ predictions of a 3.0m barrels surplus. This figure, which was the most significant drawdown seen in US crude oil stocks since January 2021, is a consequence of the release of reserves by the US government to ease energy prices.

Crude oil prices also received support from a 550,000-barrels-per-day supply disruption from Libya after protesters blockaded oil fields and export terminals. A Bloomberg report says Russia’s contribution to the global crude oil market is dwindling, with 900,000 barrels per day shaved from the output as buyers shun the product.

However, the uptick in Brent crude oil prices appears to have been limited by lower demand from China due to COVID-19 lockdowns. Consequently, crude oil prices have given up some of the intraday gains, and this may have tempered overly bullish Brent crude oil price predictions.

Brent Crude Oil Price Prediction

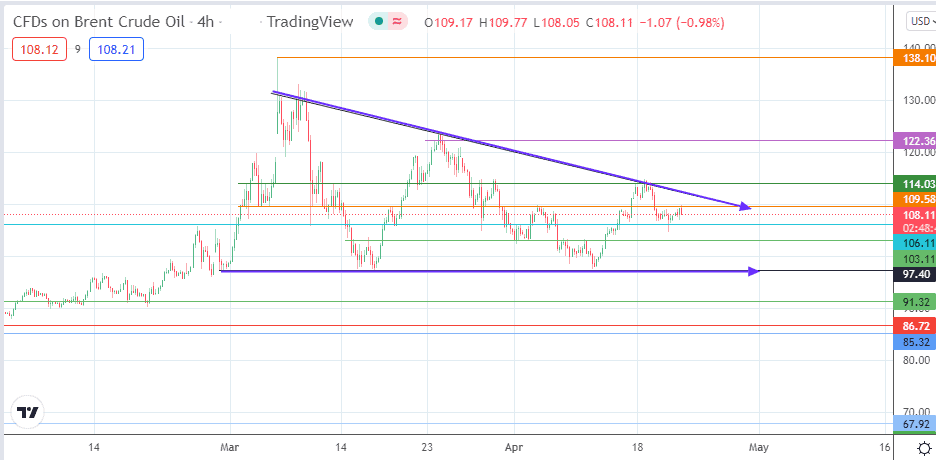

The 4-hour chart reveals an evolving descending triangle pattern, pointing to a possible correction from the multi-year highs. The bears have staved off a further advance above the 109.58 resistance. The resultant pullback will aim for the 106.11 price mark (9/18 March lows), potentially dipping further towards 103.11 or 97.40 on a stronger selloff. Additional downside targets reside at 91.32 (16 February 2022 low) and 86.72 (18/25 January lows). The measured move from the breakdown of the descending triangle is expected to close out at 85.32.

On the flip side, the bulls need to force an advance beyond 114.03 (18 April high) before 123.61 (23 March high) becomes a new upside target. This move would invalidate the triangle. Additional barriers to the north include 131.86 (8 March high) and 138.03 (multi-year high).

Brent Crude: 4-hour Chart

Follow Eno on Twitter.