- Summary:

- Here is the Brent crude oil price prediction ahead of the crude oil inventories report, as Chinese data continues to exert market influence.

After a two-day decline which included Monday’s steep 4.51% drop, crude oil price on the Brent benchmark is mildly up this Tuesday, temporarily halting additional Brent crude oil price predictions. However, the 0.45% uptick means that the price action continues to hold on to lows that were last seen in February 2022, just before the Russia-Ukraine war broke out.

In a Tuesday investment note, Commerzbank expects the continued oversupply of the energy markets and the rise in industrial stocks to exert downside pressures on crude oil prices. However, the bank notes that oil stocks did not show any substantial decreases in H1 2022 due to an inflow of strategic oil reserves into the market to plug supply deficits.

This investment note could spur additional bearish Brent crude oil price predictions, especially as recent data from the International Energy Agency (IEA) indicates that 34 million barrels of crude from strategic reserves hit the market in June 2022. Furthermore, the IEA predicts an additional 150 million barrels of state-held reserves to enter the market between July and October 2022.

Brent Crude Oil Price Prediction

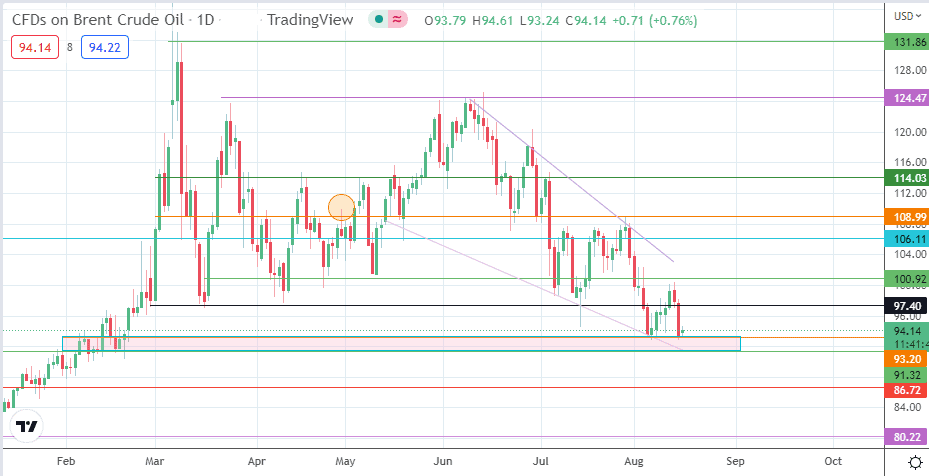

The falling wedge on the daily chart paints a picture of a bullish resolution following the end of the correction if the fundamentals align with it. Presently, the pair is attempting to find support at the demand zone, which has 93.67 as its upper border. A bounce on this zone sends the asset towards the 97.40 resistance (28 February low and 4 August 2022 high). A break of this barrier brings 100.92 (6 April low and 13 July high) into the picture.

If the bulls can uncap this barrier, this will also break the wedge’s upper border, completing the pattern. This scenario will see the 120.0 psychological barrier (10 June low, 29 July high) becoming the measured move’s completion point. The attainment of this point will depend on the bulls breaking the resistance levels at 106.11 (7 July high), 108.99 (28 July high), and the 19 April/5 May highs at 114.03.

This outlook is negated if the bears completely breach the demand zone. This move will create access to the 86.72 support level, formed by the previous low of 25 January 2022. If the bulls fail to defend this pivot, 80.22 becomes the next available downside target.

Brent Crude: Daily Chart