- Summary:

- The Brent crude oil price has made an important support. We explain what to expect now that it has struggled to move below $100.

Brent crude oil price has fallen to an important support as investors focus on the ongoing lockdown in China and OPEC+ intrigues. The benchmark is trading at $104.83, which is significantly lower than its year-to-date high of $138.10. Meanwhile, the West Texas Intermediate (WTI) has moved to $102.15, which is also lower than this year’s high of $129.50. So, what next for oil prices?

There are several catalysts moving crude oil prices. First, there is the ongoing debate in Europe about banning Russian crude oil. While most countries are supportive of the measure, some like Hungary and Czech Republic have warned about the impacts to their economies. A complete ban would have a significant impact on oil markets since Europe buys most of the Russian oil. However, analysts believe that Russia would find other buyers like China and India.

Oil prices are also reacting to the latest figures from OPEC. Official data showed that OPEC production rose by 70,000 barrels per day. Oil production in Russia declined by 900k barrels per day as the country produced 9.4 million barrels per day. In its quota, the country is required to produce 10.44 million barrels.As a result, according to S&P, the spread between OPEC+ production and quotas rose to a record high.

Other OPEC countries are also facing challenges with production. For example, in Libya, factions blockaded key ports and oil fields. Nigeria is also seeing significant logistics issues while Kazakhstan’s output fell by 220k barrels per day.

Crude oil price prediction

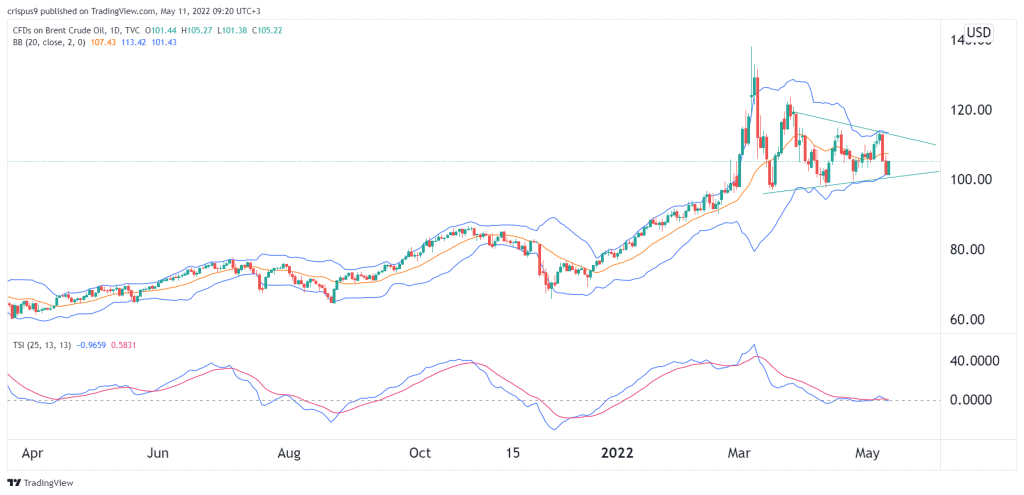

Crude oil has been a bit volatile in the past few weeks. On the daily chart, the price remains slightly above the ascending trendline that is shown in green. This is a sign that sellers are getting a bit afraid of moving below the support at $100. Oil is also between the lower and middle line of the Bollinger Bands. The True Strength Indicator has moved to the neutral point.

Therefore, there is a possibility that the crude oil price will remain in this range for a while. Besides, it has formed a triangle pattern, which is not close to its confluence level, The key support and resistance to watch will be at $100 and $110.