- Summary:

- The Brent crude oil price predictions continue to be dictated by the lockdowns in China and events surrounding the Russia-Ukraine war.

Bullish Brent crude oil price predictions have hit the market after Germany dropped its opposition to an embargo on Russian oil imports. The crude oil benchmark rose 2.06% on Thursday as a result, as the move paves the way for a potential vote to embargo Russian oil, cutting off a significant chunk of supply from the market.

Reports say that Germany will no longer oppose an EU resolution to ban the importation of Russian oil and energy products. However, any embargoes remain some way off, as the German statement only reflects Berlin’s public wishes to wean itself off Russian oil.

While the news put Brent crude on bid, the upside move was limited as lockdowns in Shanghai continue to cut demand for crude oil. Plans to start mass testing in Beijing and other cities across China may spark new lockdown fears, leading to a further reduction in demand from the world’s largest crude oil importer. Demand from China is already said to be down by 1 million barrels per day.

A slight increase in crude oil stocks also limits the rise in oil prices. The latest consignment of the Energy Information Administration’s weekly report indicates that inventories rose by 691,000 barrels in the week under focus, up from a shortfall of 8 million barrels recorded previously. The rapidly evolving situation on the geopolitical front keeps Brent crude oil price predictions on the volatile side.

Brent Crude Oil Price Outlook

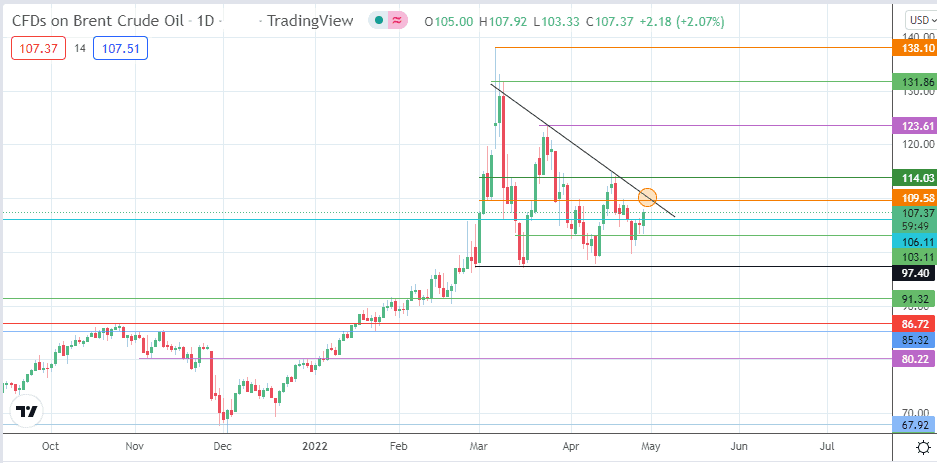

The active daily candle has breached the 106.11 resistance (9 March low, 1 April high) by the required 3% closing penetration above this barrier. This confirms the breakout and opens the door for the bulls to challenge the resistance at 109.58. The trendline that connects the price peaks from early March to date add another resistance layer.

If the bulls uncap this barrier, the door swings open for a push towards 114.03 (11 March and 19 April highs). Above this level, 123.61 (24 March high) forms an additional barrier to the north, with the 120.00 psychological price area forming a potential pitstop. This outlook would invalidate the evolving descending triangle.

On the other hand, rejection at 109.58 retains the integrity of the triangle, with the potential for a downside move that targets 106.11 initially. 103.11 (27 April low) is another pivot waiting in the wings if the bulls fail to support the 106.11 support. The 97.40 price mark (28 February and 16 March lows) forms the triangle’s lower border.

The descending triangle’s expected outcome is fulfilled if the bears take this border out. This scenario also clears the pathway to a measured move that targets 80.22 (5 November 2021 and 6 January 2022 lows). Before then, additional downside barriers are seen at 91.32 (11 February low), 86.72 (25 January low) and 85.32 (10 November 2021 high and 24 January 2022 low).

Brent Crude: Daily Chart

Follow Eno on Twitter.