- Bullish Brent crude oil price predictions could see $108 being a realistic target as several bullish triggers play out in the market.

Crude oil price on the international benchmark held above $101/barrel this Monday, enabling bullish Brent crude oil price predictions to continue playing out in the market this Monday. This ascent in crude oil prices on the Brent benchmark follows last week’s 4% gain.

Concerns about a new conflict in Libya and a potential for production cuts from Saudi Arabia, the UAE and Oman are seen as the new drivers for the rise in crude oil prices. In addition, soaring natural gas prices and heavy demand in Europe are also expected to support crude oil prices.

The proposed production cuts that Saudi Arabia is spearheading come as OPEC’s number one oil producer wants to frontload a balance of supply ahead of an expected revival of the 2015 Iran nuclear deal. The Saudi position has received support from Oman and the UAE.

Also adding to oil price pressures and renewed bullish Brent crude oil price predictions are fears of renewed armed conflict in Libya. Heavy clashes in the country over the weekend left scores dead. Armed conflict in Libya in 2011 ultimately led to the collapse of the Ghadaffi regime and disrupted oil supplies from the country, and caused a 300% spike in crude oil prices. Crude oil price on the Brent benchmark is up 1.29% as of writing.

Brent Crude Oil Price Prediction

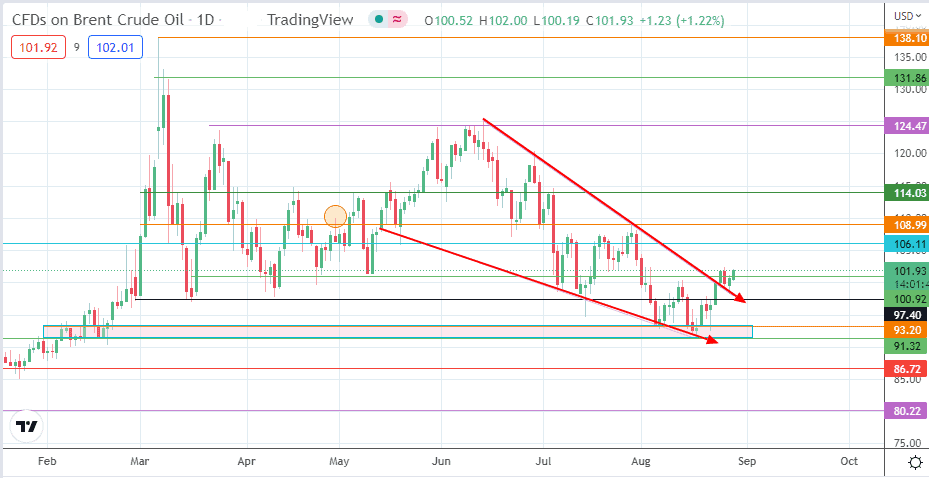

Monday’s advance pushes the price action above the 100.92 resistance level, but we need to see a penetrating close above the recent highs of 2/3 August and 24/25 August for the break of this resistance to be valid. If this occurs, the 106.11 resistance becomes the next bullish target, as this price level is the site of the previous high of 7 July and the 28 July prior low.

An advance beyond this level targets the 28 July high at 108.99, which also houses the 16 May and 24 June lows. Finally, a push toward 114.03 and 120.00 (3 March and 16 June highs at the psychological price mark) would complete the measured move from the wedge pattern’s break.

Conversely, the bears would need to see a breakdown of 97.40 (28 February and 16 March lows) and the demand zone, whose range extends from 93.20 to the lower ridge at 91.32, for the 86.72 price support to come into the mix as an initial downside target (26 October 2021 high and 25 January 2022 low). A breakdown of this area following a lack of bullish protection brings in the 4 November 2021 and 5 January 2022 lows at 80.22 into the mix as a further target to the south.

Brent Crude: Daily Chart