- Crude oil price on the Brent crude benchmark looks set to rise further as the OPEC + alliance meets to consider a new output cut proposal for February.

Crude oil price on the Brent benchmark is up on the day as the OPEC + alliance resumes talks this Tuesday on the February production output. The talks come on the back of rising tensions in the Middle East that were provoked by the seizure of a South Korean vessel by Iran.

According to a Reuters report, the OPEC + alliance is studying several output scenarios, one of which is a proposed 500,000 barrels per day output cut.

According to market watchers, Russia and Saudi Arabia once more find themselves at odds on the pathway to proceed on, with Russia favouring an increase in production, citing recovering demand. The Saudis favour maintaining or reducing production quotas, citing the worsening coronavirus situation.

Brent crude is up 2.03% at the time of writing.

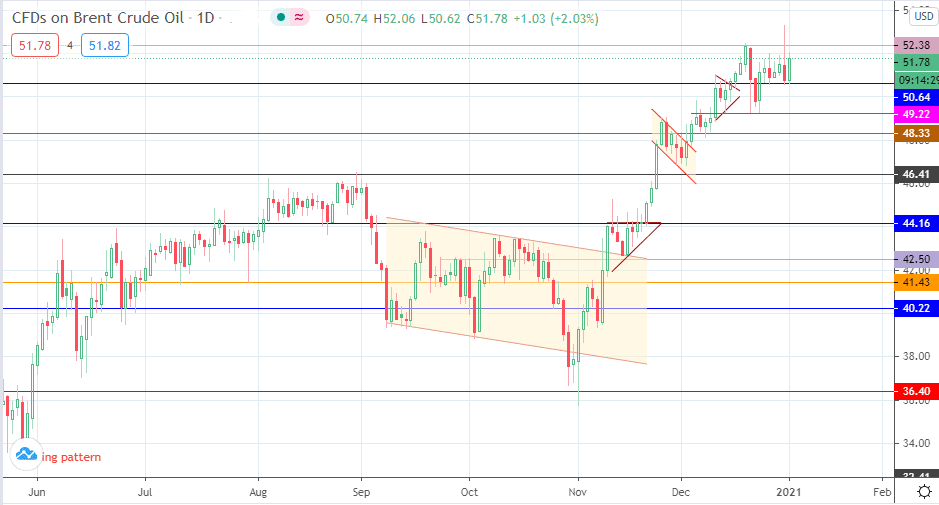

Technical Outlook for Crude Oil Price

The 50.64 support level remains key to the current crude oil price situation. It has formed the fulcrum of bullish action all week and served as Tuesday’s intraday low. The next target for bulls is 52.38 (18 December 2020 high). This level was violated on Monday, but bears forced prices lower to kill off chances at a breakout. It remains the price to beat for bulls.

On the flip side, an increase in production is a bearish factor which could see sellers challenge 50.64. A breakdown of this area targets 49.22 (21/23 December lows), with 48.33 and 46.41 serving as further targets to the south.

Crude Oil Price (Brent); Daily Chart