- Summary:

- The BP share price is down more than 2% after a sharp selloff in crude oil prices as a result of a rise in US oil stocks.

- BP share price falls more than 2% on Wednesday.

- Falling crude oil prices provoked the selloff in oil stocks.

- Rising US inventories to blame ahead of OPEC + meeting.

Today, the BP share price took a heavy hit after crude oil prices lost nearly 3% of their value. The BP share price fell 2.38% as of writing after the Energy Information Administration reported a rise in US crude oil inventories by 3.3million barrels in the week ended October 29.

The rise in inventories has sparked off fears that the US could release some of this extra inventory into the market to force down prices if the OPEC + alliance fails to raise its output when it meets on Thursday and Friday.

Despite the downturn in price, analysts at RBC Capital continue to retain their “buy” recommendation for BP, as it expects significant share buybacks in 2022. The RBC Capital research team is maintaining its price targets on the stock.

BP Share Price Outlook

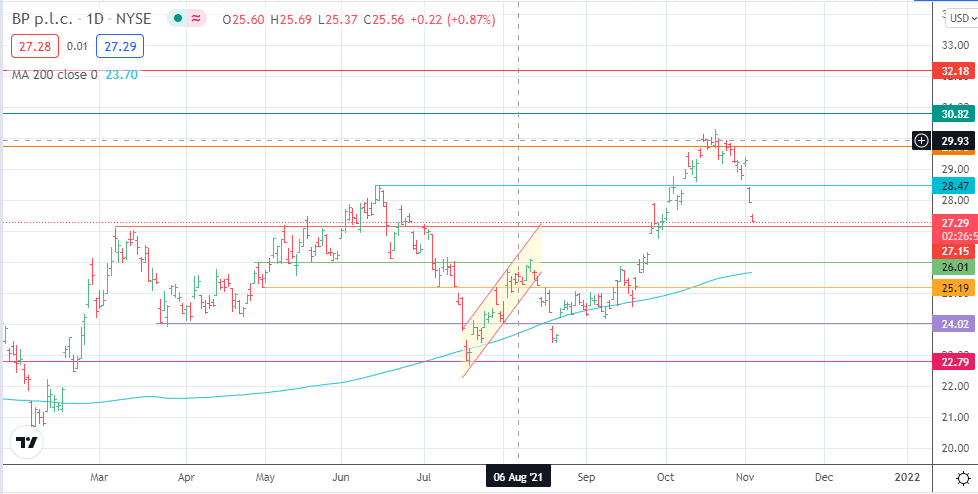

The bearish “gap and go” move is about to test support at the 27.15 support level. If this support gives way, 26.01 and 25.19 come into view in succession. The 200-day moving average may also become a factor at this point, and only when it gives way can an expectation of price reaching 24.02 be met.

On the flip side, a return towards 30.82 is needed to restore the uptrend. This move requires a support bounce that takes out resistance levels at 28.47 and 29.73. Attainment of 30.82 also involves a breach of the recent tops at 30.29 (October 20 high). If the uptrend takes out 30.82, 32.18 becomes available.

BP: Daily Chart

Follow Eno on Twitter.