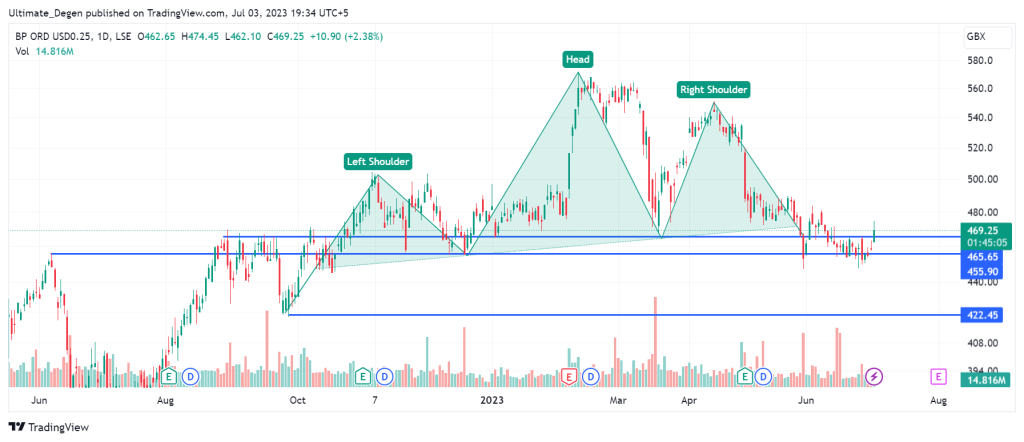

- BP Share Price Forecast: LON: BP is heading for a retest of the H&S neckline. A rejection from the current level will be very bearish.

BP (LON: BP) share price has rebounded strongly from the June lows. The shares of the British oil giant dropped below 450p last month before starting a recovery. On a higher timeframe, BP stock remains 17.5% down from its yearly peak.

On Monday, the FTSE 100 index opened higher as most UK shares turned green. However, the gains were lost as the US markets opened. Till press time, the FTSE 100 index was down more than 12 points. BP shares remained green and were up 2.35% during the first trading session of the week.

BP plc & Reliance Initiate Production From MJ Field

The latest BP plc news is about the commencement for production from the MJ field by BP plc and Reliance Industries Limited (RIL). MJ field is one of the three deepwater developments on which Reliance and BP are working together off the coast of India. The overall production from the whole project will be 1 billion cubic feet when it reaches its peak.

The recent surge in BP share price coincides with a similar rise in oil prices. If the oil demand keeps increasing in the coming weeks, the downtrend in LON: BP may also end. Another factor affecting the price action will be the strength of the state of the UK & US economies.

BP Share Price Retests H&S Neckline

As mentioned in my previous forecasts, BP chart shows a breakdown from the head & shoulders pattern. It seems that the price got strong support from the 450p level, which is not surprising. The demand from this level has pushed the price for a retest of the neckline of the head & shoulders pattern.

A rejection from the neckline will make BP share price forecast extremely bearish. In this case, the price may drop below 450p once again, with the long-term bearish target of 422p on the horizon. The technical target of H&S breakdown is actually 388p, which seems achievable if the UK & US economies run into a recession later this year.

In the meantime, I’ll keep sharing updated BP share price analysis and my personal trades on my Twitter, where you are welcome to follow me.