- BP share price has made a spectacular comeback, making it one of the top performers in the FTSE 100. What next for the stock?

BP share price has made a spectacular comeback, making it one of the top performers in the FTSE 100. The shares rose to the year-to-date high of 465p. This price was its highest point since 2020 and was about 40% above the lowest level this year.

Crude oil prices rebound

The BP share price has bounced back in the past few weeks as investors react to the rebounding oil and gas prices. Brent, the international benchmark, has risen from about $90 in July to over $104. West Texas Intermediate (WTI) and other major benchmarks have also continued rising in the past few days.

The rally of crude oil prices is mostly because of the recent rumours about OPEC. Media publications like the WSJ and Bloomberg have reported that Saudi Arabia is considering slashing production in a bid to leave prices at elevated levels. They will likely reach that agreement in the coming meeting that is set to happen in September.

BP, like the other oil and gas prices like Aramco and Shell, do well when oil prices are at an elevated level. This explains why BP reported strong results for the second quarter. The firm’s revenue of over $67.87 billion was higher than the expected $60.86 billion. Its earnings-per-share of 44 cents was bigger than the expected 34 cents. As a result, the firm announced strong shareholder returns like dividends and buybacks.

Still, there are concerns about the BP share price valuation. According to Simply Wall St, BP shares are about 40% overvalued based on a discounted cash flow (DCF) calculation. Still, based on the sluggish historical performance, BP is a bit undervalued compared to its peers based on key multiples.

BP share price forecast

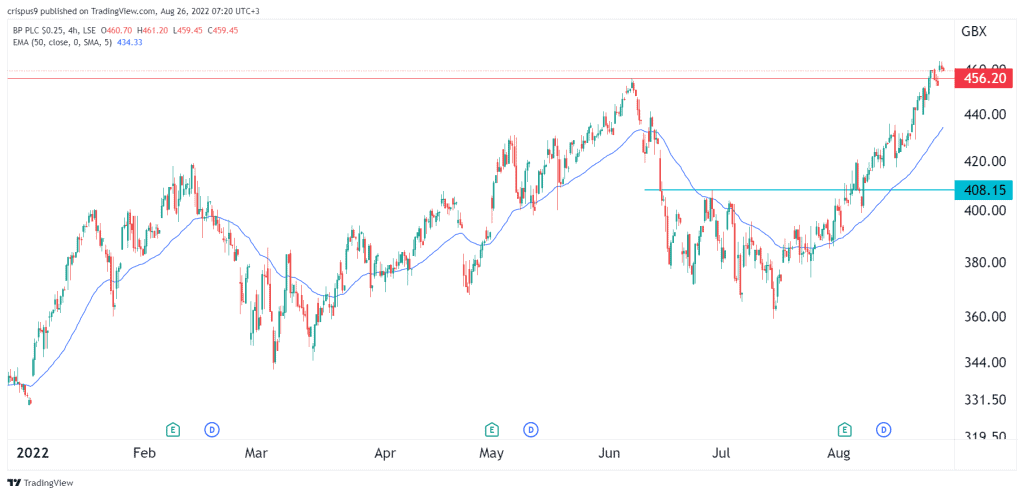

The four-hour chart shows that the BP stock price has been in a strong bullish trend in the past few weeks. This comeback accelerated when the shares moved above the important resistance at 408p, which was the highest point on June 29. It has rallied above the 25-day and 50-day moving averages.

Notably, the stock has formed what looks like a cup and handle (C&H) pattern. As a result, there is a likelihood that the shares will continue rising as bulls target the next key resistance at 500p. A drop below 440p will invalidate the bullish view.