- Summary:

- BP share price staged a strong rally as the soaring crude oil prices helped to offset a large fire at its Whiting refinery.

BP share price staged a strong rally as the soaring crude oil prices helped to offset a large fire at its Whiting refinery. The stock jumped to a high of 464p, which was the highest point since 2020. It has risen by 145% from its lowest level in 2020 when the pandemic struck. Similarly, the Vanguard Energy ETF (VDE) has also rebounded.

Higher oil and gas prices

BP’s share price remained elevated as BP came under scrutiny again in the United States. The company’s Whiting plant in Indiana caught fire last week, which will cost it millions of dollars. The firm is now working to conduct a phased restart for its refinery that handles over 400k barrels of oil daily.

The rising oil and gas prices offset the crisis at Whiting. Brent rose to $99 while West Texas Intermediate (WTI) jumped to $93. Analysts expect that oil prices will likely continue doing well in the coming weeks as OPEC+ members consider supply cuts in a bid to support prices. The cartel will hold its meeting next week.

Meanwhile, the company is benefiting from the rising natural gas prices in Europe. We believe that Putin will ultimately stop natural gas flows to Europe in the coming months, especially if oil prices remain at elevated levels. If this happens, natural gas prices will continue rising, which will benefit players in the sector like Shell and BP.

BP share price also rose after the company’s strong returns recently. Its underlying profit rose from $6.2 billion in Q1 to over $8.5 billion in Q2. It had made $2.8 billion in the same quarter in 2021. At the same time, the company spent about $3.9 billion buying its own shares. As a result, it is now repurchasing stock worth $3.5 billion.

BP share price forecast

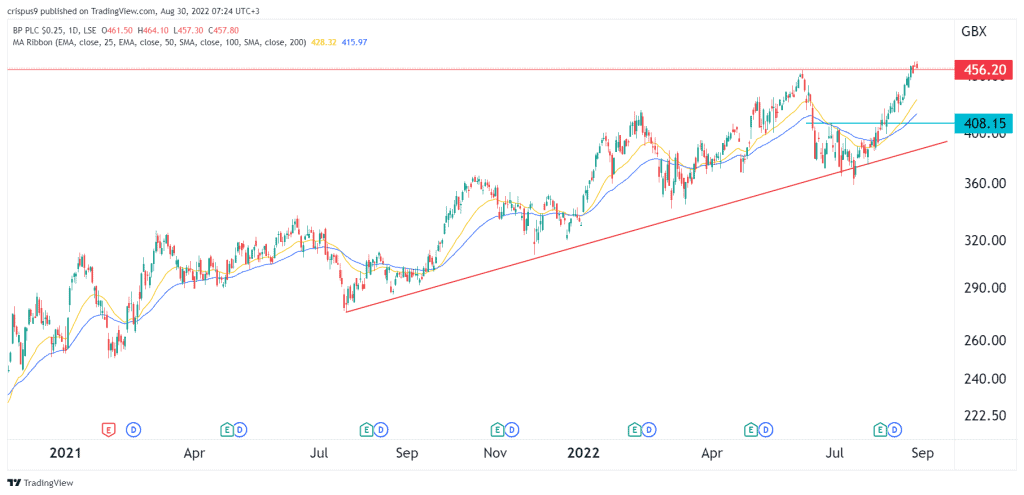

The daily chart shows that the BP stock price has been in a strong bullish trend in the past few months. It rallied to the highest point in two years and moved above the ascending trendline shown in red. In addition, the stock has moved above the 25-day and 50-day moving averages.

As I wrote before, the shares have formed a cup and handle pattern. Therefore, there is a likelihood that the shares will continue rising as bulls target the next key resistance at 500p. A drop below the support at 445p will invalidate the bullish view.