- BP share price has been in a tight range in the past few days. We explain why the break and retest pattern will push it higher soon.

The BP share price has struggled slightly in the past few days. The stock is trading at 344p, which is a few points below the year-to-date high of 366p. Still, the shares have rallied by more than 70% from the lowest level in 2020.

What happened? BP, like other energy companies, has done relatively well this year. Indeed, the stock has outperformed most companies in the FTSE 100. This trend has been helped by the relatively higher oil and gas prices.

The company has also announced strong quarterly results. Last week, the company said that its underlying profit soared to more than $3.3 billion in the third quarter. This growth was helped by the relatively higher oil prices. It also did well because of its trading business.

As a result, the company said that it will acquire an additional $1.2 billion by early next year. Share buybacks help to boost corporate profits by increasing earnings per share (EPS). In the call, the company also likened itself to a cash machine.

Meanwhile, the BP share price has lagged after reports emerged that the company was in talks to acquire JX Nippon’s stake in North Sea Andrew Area oil and gas fields. If the deal is announced, it will be a reversal since the compamy wanted to sell its stake to Premier Oil. The company has also been reducing its stake in the North Sea.

At the same time, BP share price is trading at a discount. It has a PE ratio of about 14%, which is lower than the UK average of 21.

BP share price forecast

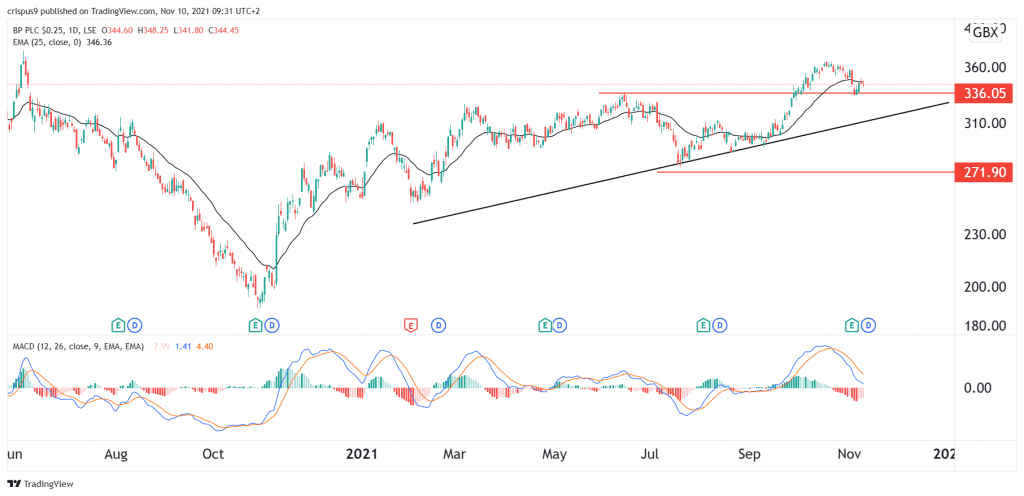

On the daily chart, we see that the BP share price rose above the key resistance level at 336p in October. This was an important level since it was the previous year-to-date high.The stock remains above the short and long moving averages and the ascending trendline that is shown in black.

A close inspection of the chart shows that it is forming what is known as a break-and-retest pattern. This is where it retests a previous support level. The pattern is usually a bullish sign.

Therefore, the BP share stock price will resume the bullish trend soon. The next key resistance will be at 400p. This view will be invalidated if it drops below 300p.