- Summary:

- The BP share price jumped by more than 6% on Tuesday as demand for oil and gas companies rose. It was the second-best stock in the FTSE 100

The BP share price jumped by more than 6% on Tuesday as demand for oil and gas companies rose. It was the second-best performing stock in the FTSE 100 after IAG. Other oil and gas shares that did well as UK markets reopened were Tullow Oil and Royal Dutch Shell.

BP is one of the biggest oil and gas companies in the world. The stock jumped on Tuesday as investors cheered the latest trends on Omicron.

While the number of cases has jumped, investors are excited because the variant seems to be a bit milder than Delta. This is evidenced by the fact that the number of cases have jumped at a time when death rates are falling. Therefore, analysts expect that BP and other energy groups will keep seeing strong demand.

The BP share price also rose after the latest OPEC+ meeting. The cartel decided to stick with its measures that call for a 400k supply increase. A report by its technical team noted that demand will be strong despite the variant.

This means that BP and other oil and gas companies will continue benefiting from higher oil and gas prices in 2022.

BP share price forecast

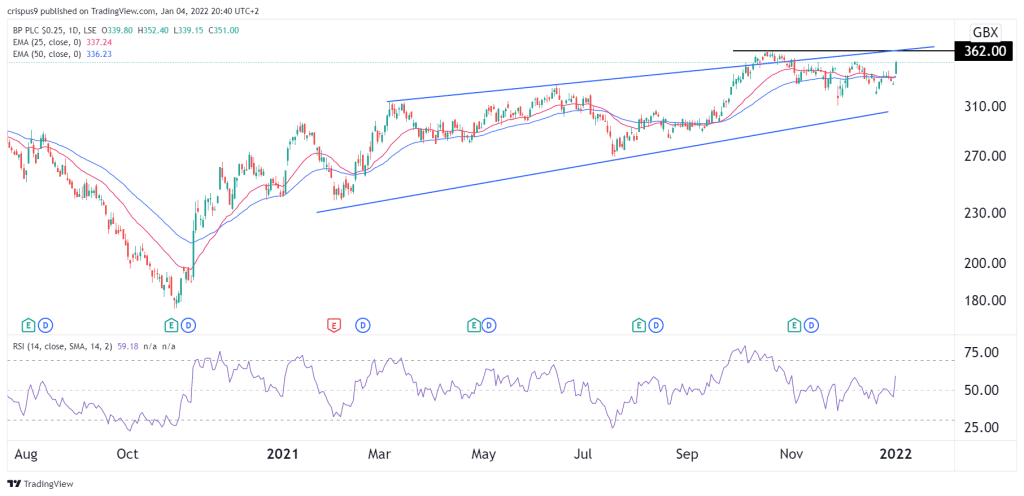

The daily chart shows that the BP stock price jumped on Monday. It is approaching the upper side of the ascending channel shown in blue. It has also managed to move above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved above the neutral level of 50.

Therefore, the path of the least resistance for the BP share price in January 2021 is in the upside. This trend will push the stock to the key resistance at 365p. On the flip side, a drop below 340p will invalidate the bullish view.