- Summary:

- BP share price has traded downward for much of the year, but China's move to announce economic stimulus could trigger a turnaround.

BP share price has been on a general downtrend since late April, and it didn’t make the most of increased travel during the summer. The stock is down by 12.1 percent this year, but has gained a marginal 0.2 percent in the last five trading sessions. BP has been running a share buyback program, with the latest purchase happening on September 23rd and involving the purchase of $1.34 million worth of shares.

However, the market has seemingly been numb to the share buyback program, choosing to focus on the broader market outlook. The company reported revenues of $46.81 billion, a decline of 2.74% for the quarter ending June. However, it beat EPS forecasts by 5.76 percent and had a healthy operating cash flow of $8.1 billion. Nonetheless, its $22 billion debt is a drag on its upside, considering that the company’s market cap stands at $87.9 billion as of this writing.

Global oil prices have face headwinds this year, with China’s decreased economic growth rate leading to reduced demand. This has offset the geopolitical premium on oil prices brought by the spike in hostilities in the Middle East. However, China just announced an economic stimulus program that could trigger increased industrial activity and demand for oil.

Meanwhile, BP will pause its offshore operations in the Gulf of Mexico region, as Hurricane Francine strengthens. That will be the second hurricane disruption in two weeks, and the impact will be felt by BP share prices.

BP share price forecast

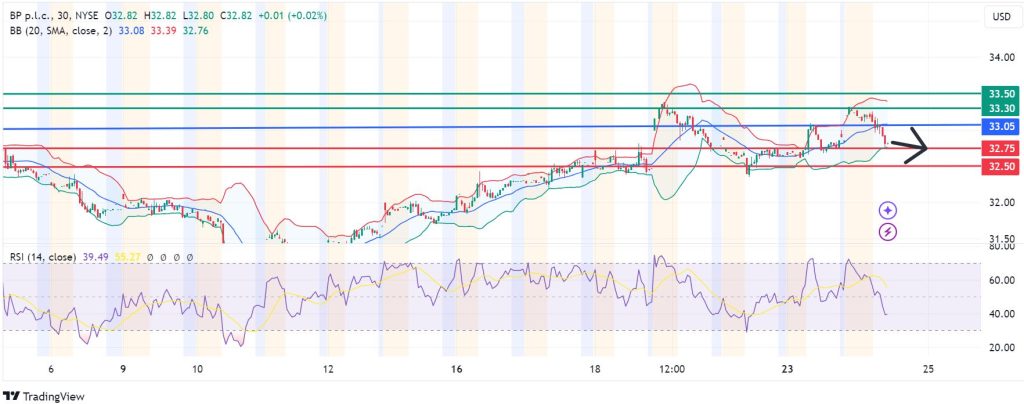

BP share price has pivoted at 33.05 and the downside will likely prevail if resistance persists at that level. That could see the first support coming at 32.75, but a stronger bearish control could extend losses to breach that level and test 32.50.

Conversely, moving above 33.05 will signal control bythe buyers. In that case, initial resistance will likely be at 33.30. However, a stronger momentum by the bulls could break above that level, invalidate the downside narrative and test 33.50.