- Summary:

- Two weeks after releasing its financial report, BP's share price continues to surge, with the bullish trend continuing today.

Two weeks after releasing its financial report, BP’s share price continues to surge, and in the early hours of today’s trading session, the trend is looking poised to continue the bullish trend. Early this month, the company announced it had made a profit of £6.9 ($8.45) billion between April and June.

This was the highest recorded profit the company had recorded in the past 14 years. The amount was also three times what it had recorded during the same period last year. The announcement triggered the markets and kickstarted the current aggressive push to the upside.

The record-breaking profits came amidst surging gas prices in the UK. The company’s windfall has also coincided with the sanctioning of one of Europe’s largest oil producers, Russia, for invading Ukraine.

BP Share Price Analysis

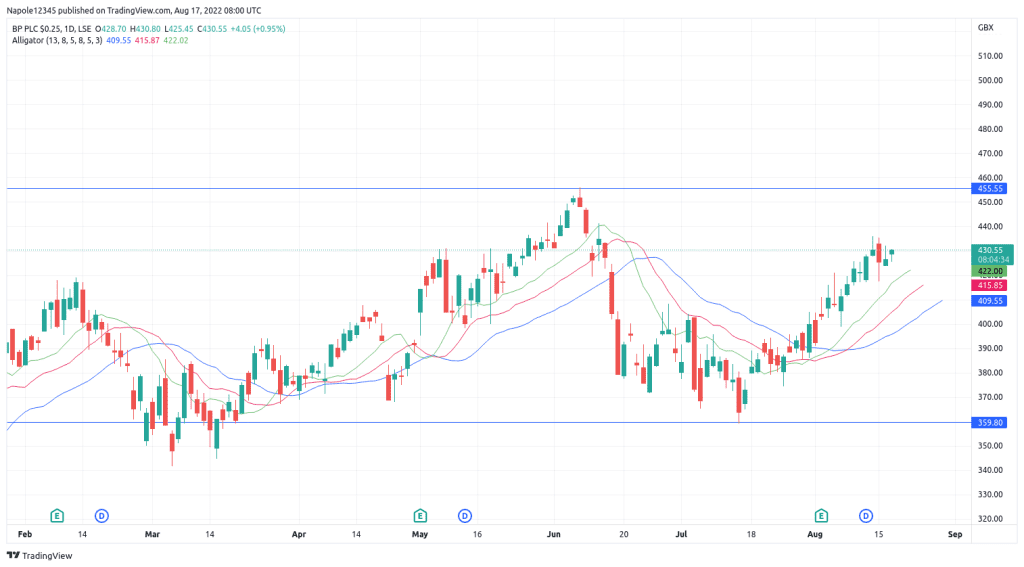

Following the record-breaking profits announcement, BP’s share price has continued to trade aggressively bullish for the past few weeks. Today, with prices already up by a percentage point in the early hours of the session, the bullish push is looking likely to continue.

Therefore, there is a chance that we might see prices closing the session trading higher. In the next few trading sessions, I also expect the current strong and aggressive bullish trend to continue. We are highly likely to see prices hitting the 455p price level.

This analysis is partly because the gas and energy prices are still high, which means the company will continue to make record-breaking profits in the foreseeable future. A price level above 500p is also a possibility based on the current strong and aggressive push to the upside.

However, if prices fall below the 400p price level, then my analysis will be invalidated. Trading below that price level will be a sign that BP investors are selling off their assets.

BP Daily Chart