- Summary:

- The Boohoo share price has had a rough start of the year as concerns about growth and competition have remained.

The Boohoo share price has had a rough start of the year as concerns about growth and competition have remained. The BOO stock is trading at 109p, which is a few points above last year’s low of 97.30p.

Boohoo and other fashion-related stocks in the FTSE 250 index have struggled in the past few months as concerns about competition and supply chains remain. For example, the Asos share price is trading at 2,140p, which is about 65% below its highest level in 2021.

Boohoo shares have struggled as investors remain worried about the rising competition from discount companies like Shein. Investors also worry that the supply chain challenges going on will have a negative impact on the company’s growth.

And as the economy is expected to continue its reopening process, analysts expect that Boohoo will struggle with low growth.

Still, some analysts believe that the Boohoo share price has gotten extra cheap and that the worst-case scenario has already been achieved.

Boohoo share price forecast

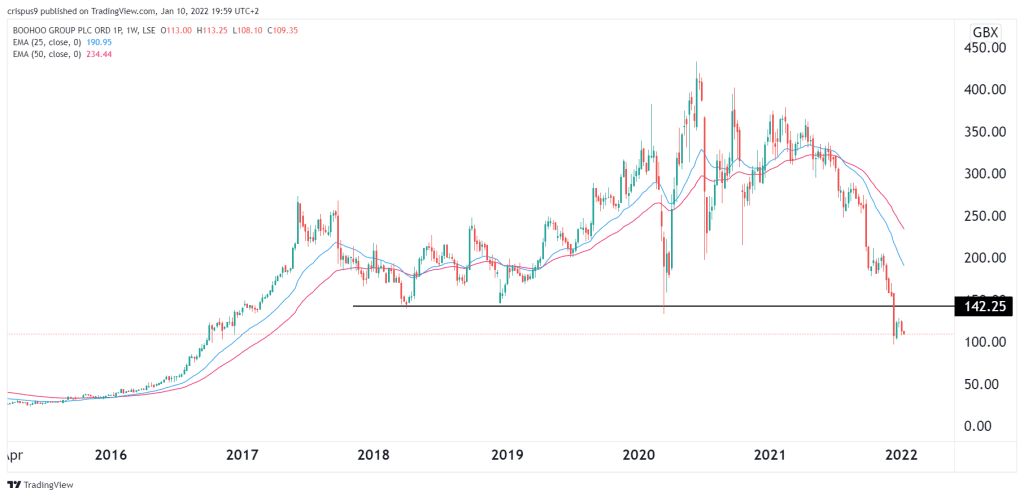

The weekly chart shows that the BOO share price has been in a strong bearish trend in the past few months. As a result, the stock has managed to move below the 25-day and 50-day moving averages. It has also moved below the Ichimoku cloud while the Relative Strength Index (RSI) has been in a downward trend.

The stock also crossed the key support level at 142p, where it struggled moving below in March 2018 and March 2020. Therefore, while the Boohoo share price will likely bounce back later this year, for now, the bearish trend will likely continue.