- Summary:

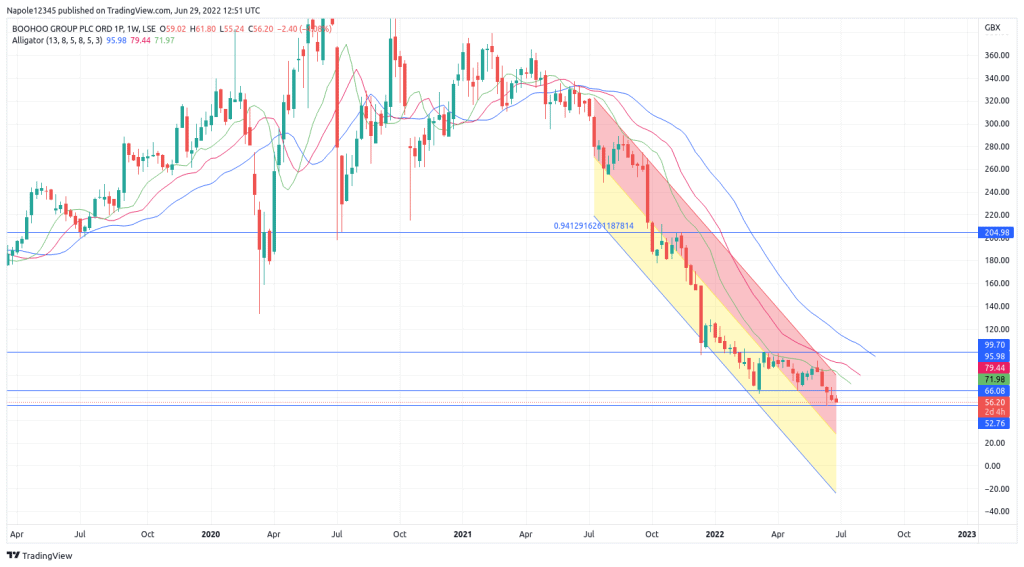

- Boohoo share price has not performed in months, losing 34 percent of its value in June and 54 percent year-to-date

On the downside, the boohoo share price has only had one direction throughout the month. Currently, the share price is down by a percentage point. However, in the morning hours of the trading session, Boohoo’s share price was aggressively bearish, which resulted in prices dropping by 2.5 per cent before recovering to the current levels.

Boohoo Share Price History

The Boohoo share price is down by 34 per cent in June. The drop tells a story of a company that has struggled for the entire year. This month’s drop also reverses May’s 5 per cent gains, which is the only month that saw its share price rise.

Looking at the year-to-date data, Boohoo has lost 54% of its value. The data also shows that the 2022 price drop may be an extension of a long-term bearish trend that started 12 months ago, which has resulted in Boohoo’s share price dropping from trading at 315p to the current price of 55p, an 83 per cent decline in the markets.

Why is Boohoo Share Price Dropping?

Over the years, Boohoo has faced many challenges that have stunted its growth. However, the current challenges resulting in the current price drops are retail industry problems as a whole.

The first challenge causing Boohoo to continue dropping is the rising cost of living, fueled by inflation. The issue has resulted in a decline in customer spending on the platform, affecting their profit margins. In addition, inflation has also resulted in the cost of operations rising and eating into profits.

The fast fashion industry is also undergoing a silent revolution that is aimed at reducing its environmental impact. Therefore, companies that produce their goods have also been forced to increase their prices, which is also negatively impacting Boohoo’s profit margins. All these issues have hindered the company’s ability to grow and resulted in the current bear market.

Boohoo Share Price

Despite the drop and the current bear market, Boohoo’s share prices are likely to start recovering immediately after the inflation issue is addressed. There is a high likelihood that operations and costs will come back down.

However, as of now, I remain bearish on Boohoo’s share price, and I expect the price to trade below 50p. There is also a high likelihood that prices may fall to trade below 45p.

Boohoo Daily Chart