- Summary:

- The Boohoo share price has opened lower this Thursday, but there are hopes that the stock will start to recover soon.

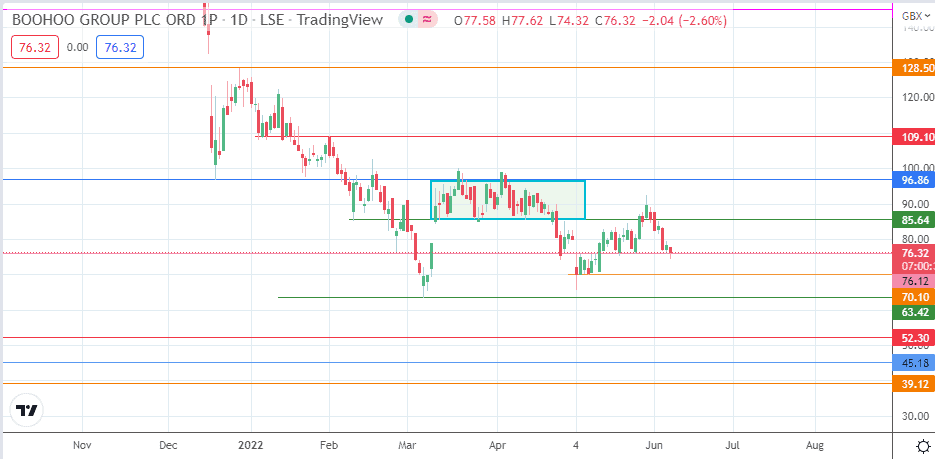

The Boohoo share price has started the day on a negative note, as the stock struggles to command the attention of investors this Thursday. The stock is presently down 3.27%, but the downside appears limited by the presence of a strong support level at 76.12p.

The decline makes it four out of six trading sessions that the bears have dominated proceedings. This scenario indicates a truncating of the attempts at the recovery of the Boohoo share price, which pushed up from its latest low at the 70p psychological level beyond the 90p mark before the correction.

This comes despite the company launching several new sets of collections with various themes that intend to mark the Queen’s Jubilee celebration. The company has also tapped Megan Fox for its new summer collection. Late last month, RBS Markets provided an update which brought succour to the company’s investors. The bank sees a 41.6% upside in the Boohoo share price in the next 12 months.

Boohoo was the toast of investors during the peak of the COVID-19 pandemic, as demand for their indoor wear rose among locked-down UK residents. However, the reopening of the economy has led to a slump in the company’s fortunes, with the last nine months bringing a 67.5% decline in the Boohoo share price.

BooHoo Share Price Forecast

The Boohoo share price’s active daily candle is testing the support at 76.12 (19 May and 25 May lows). A breakdown of this support allows the bears to push toward the 70.10 pivot, where the lows of 6-10 May 2022 are found. A further price deterioration leads to a breakdown of 70.10, bringing 63.42 (7 March low) into the picture as a new downside target. A further decline brings in multi-year lows at 52.30 and 45.18 as additional targets to the south.

However, if the bulls save the support at 76.12, we could see a bounce that takes the price action toward the 85.64 barrier. This is the 9 February and 24 March lows and the site where the completed rectangle pattern’s floor resides. Above this resistance, an additional barrier is formed by the rectangle’s ceiling at 96.86. The 1 February high at 109.10 forms a northbound target above 96.86, leaving 120.00 and 128.50 as multi-month targets presently not viable.

Boohoo: Daily Chart