- What is the outlook of the Boohoo share price? We explain what to expect now that the stock has sold-off sharply in the past few months.

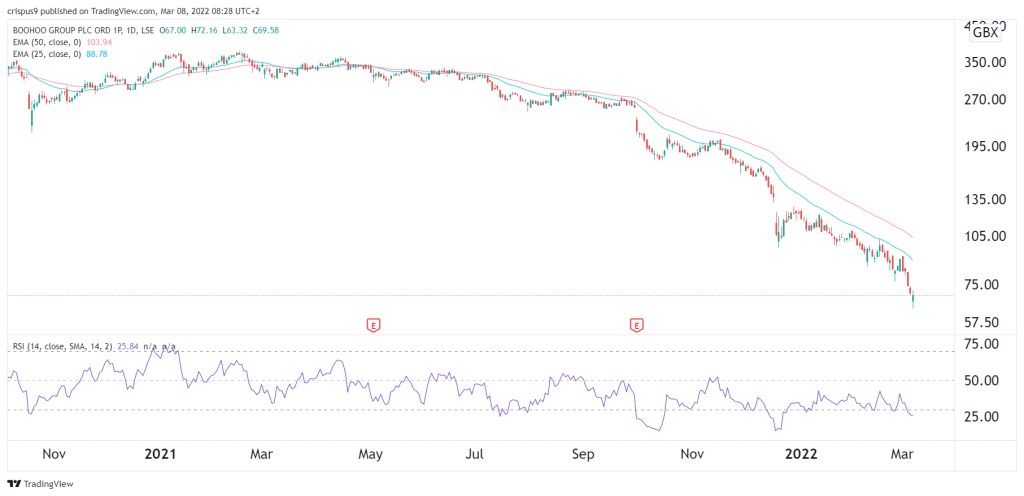

The Boohoo share price remained under intense pressure in the past few months as the company continues to face significant challenges. The stock is trading at 69.58, a few points above the year-to-date low of 63.72. Other companies in the industry have also struggled, with the Asos share price hovering near its lowest point since April 2020 and Next trading at its September 2020 lows.

Boohoo and other companies in the fashion industry are fighting multiple battles at the same time. In the first place, the company is battling a situation where its revenue growth is expected to slow down as the UK and key markets reopen. Boohoo has even lowered its guidance multiple times in the past few months.

Boohoo and other companies in the fashion industry are fighting multiple battles at the same time. In the first place, the company is battling a situation where its revenue growth is expected to slow down as the UK and key markets reopen. As a result, boohoo has even lowered its guidance multiple times in the past few months.

There is also an additional cost of doing business as labour and logistics costs escalate. For example, recent data from the UK showed that the average wages had risen sharply in the past few months. In addition, shipping companies have had to increase the cost of doing business because of the supply chain challenges increase.

The BOE and the Fed have also embraced a hawkish tone, which negatively impacts growth stocks. Therefore, there is a likelihood that Boohoo will see thinner margins when growth is slowing.

But there are positives that could push the Boohoo share price higher in the long term. It is a profitable company that is a well-known brand in the UK and its key markets. Also, the management is improving the supply chains while the stock is significantly undervalued. There is also chatter that some private equity companies could make a bid.

Boohoo share price forecast

The daily chart shows that the BOO stock price has been in a strong sell-off lately. As a result, the shares have managed to move below the 25-day and 50-day moving averages. It has also fallen below the key support level at 70p while oscillators have moved to the oversold level. Therefore, there is a likelihood that the shares will keep falling for now and then rebound in the coming months as these challenges start easing.