- Summary:

- The boohoo share price continued to take a beating in the markets in today’s trading session, dropping by a percentage point.

The boohoo share price continued to take a beating in the markets in today’s trading session. In the early hours of the session, the prices had dropped by over 5 per cent. However, the share price recovered by 4 per cent and is currently only down by a percentage point.

Why is Boohoo struggling?

Across the UK, retail stores are seeing a decline in sales as soaring inflation hits household finances. In an analysis compiled by the Financial Times, data showed that retail sales volume declined for the third month in June. The data also showed the fall was at an annual rate of 1 per cent based on data compiled by advisory services group KPMG and the British Retail Consortium industry body.

The data showed a problem currently faced by retail companies such as Boohoo. Soaring inflation has seen consumers of online fashion stores cut the amount they are spending. The result has also seen the company having to change how it operates to meet its bottom line.

Inflation has also seen the company change some of its policies. Recently, Boohoo announced they would add a £1.99 return charge. The company blamed rising operation costs and shipping costs for the change in policy.

Boohoo Share Price Analysis

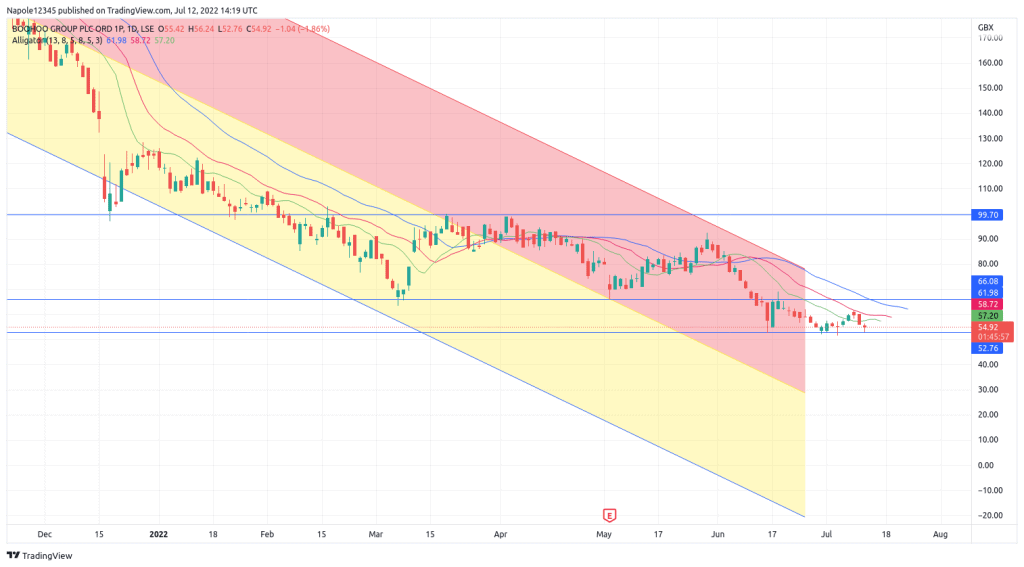

Looking at the daily chart below, the Boohoo share price has resumed its aggressive bearish trend. However, the chart also shows the prices touched the 52p support level and failed to break to the downside.

Adding the fact that the company is operating in a tough economic environment that includes inflation and a high cost of living, I expect the prices to continue falling. There is a high likelihood that we will see the price drop to trade below the 50 price level. With enough momentum, there is a high chance that the price will also hit the 40p price level. However, my bearish analysis will be invalidated if economic conditions improve. A bullish recovery may also happen.

Boohoo Daily Chart