- Shein is a threat for Boohoo share price. We explain why the BOO shares could benefit from this remarkable success.

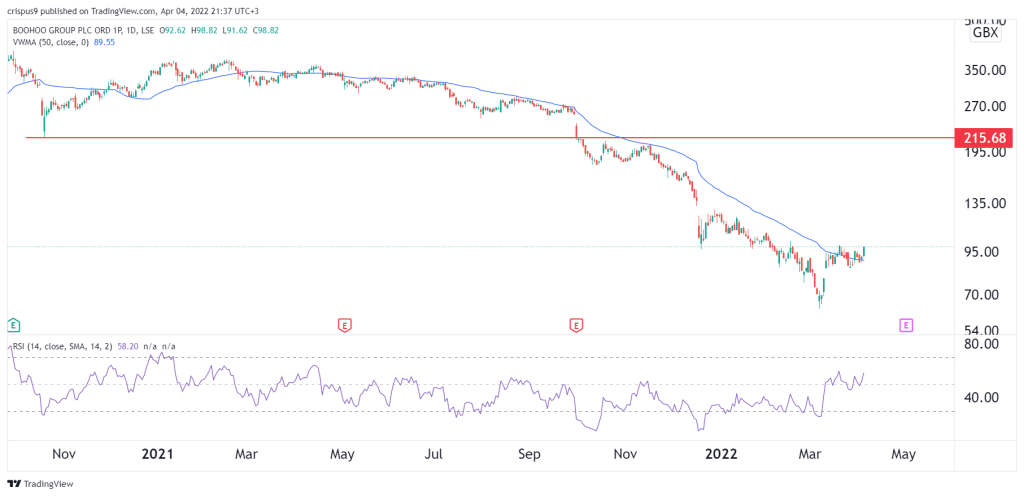

The Boohoo share price has held steady in the past few weeks as investors bet on the resurgence of the fast-fashion giant. BOO shares rose to 98.82p, the highest point since March 21. This price was about 56% above the lowest level this year. However, it is still 78% below its highest level in 2020, bringing its total market cap to about 1.25 billion pounds.

The BOO stock price rose on Monday as investors expressed optimism on fashion companies. Indeed, other stocks in the sector like Asos and Next also did well. The main catalyst was that Shein, the leading Chinese fast-fashion company, was seeking funds in the market. If the fundraising is successful, the company will be valued at over $100 billion. As a result, it will become bigger than H&M and Zara combined. The firm’s sales in 2020 rose to over $10 billion.

Shein and other fast-fashion companies in China are some of the biggest threats facing Boohoo and other companies in the industry. These firms have mastered the science of supply chain, meaning that they can produce their products at a lower price. They also cater to more international customers. And unlike Boohoo, which must be careful about labour practices, these companies are not put under much scrutiny.

Still, the strong performance of Shein could boost the Boohoo share price. Moreover, this rising competition could lead to more mergers and acquisitions in the industry as companies seek to grow their market share. Therefore, while no deal has been announced, we can’t rule out a situation where companies like Inditex, H&M, and even Shein itself made a bid for Boohoo. Besides, the company is one of the cheapest in the UK.

Boohoo share price forecast

I noted that the shares may have bottomed in my last Boohoo stock price forecast. This view was partly accurate since the stock has risen by over 50% even as the company has faced rising supply chain disruptions.

The stock has moved above the 50-day volume-weighted moving average (VWMA) the Relative Strength Index (RSI) has moved above the neutral level. Therefore, there is a likelihood that the stock will keep rising in the coming weeks.