- Summary:

- The Lloyds share price is up this morning after the BofA upgraded the stock's price target. BoE rate hike expectations also at play.

The Lloyds share price is up this Monday, buoyed by expectations of additional monetary policy tightening and an upgrade to the share price target by the Bank of America.

The recent advance, which has seen the Lloyds share price gain roughly 2.5p in the last one week, comes as analysts at the Bank of America (BofA) raised their price target for the stock, citing a gearing to higher interest rates and resilience to economic shocks.

In a research note to its clients, the investment bank indicated an expectation of “faster improvement in profitability,” with more capital generation and increased distribution to shareholders.

The net interest margin for Lloyds stands at a premium of 30 bps beyond the Q4 2021 levels, and BofA says that the bank’s credit quality was robust. Consequently, the bank raised its Lloyds share price target from 57.0p to 60.0p.

Investors have applauded the improved outlook and have sent the Lloyds share price higher this Monday by 0.65%. However, the gains remain capped at a key resistance. A fundamental trigger for the stock comes up later this week when the Bank of England (BoE) presents its interest rate decision. The markets predict a 25 bps hike.

Lloyds Share Price Forecast

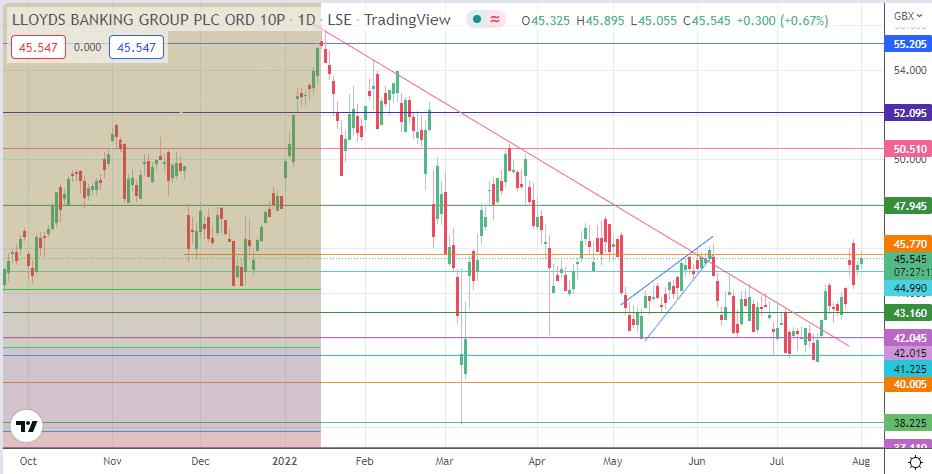

The active daily candle is facing resistance at the 45.77 price mark (30 May high). A break of this level allows the breakout move from the descending trendline to continue, targeting 47.945 (8 December 2021 and 14 March 2022 highs). 50.51 (29 October 2021 and 22 March 2022 highs) and 52.095 (18 February 2022 high) are additional northbound targets that could serve as harvest points for the bulls on a continued advance.

On the flip side, a pullback following a successful rejection at 45.77 leads to a decline that retests the 44.99 pivot (25 April and 1 June 2022 low). Subsequent southbound targets at 43.160 and 42.0245 (12 May and 18 July 2022 lows) come into the mix if the bulls fail to defend the pivot at 44.99. Finally, the downtrend resumes if the psychological support at 40.00 and the 7 March low at 38.22 are taken out.

LLOY: Daily Chart