- Summary:

- In this article we take a shot at Boeing stock price forecast in 2024 and beyond. After forming a yearly peak in August, NYSE: BA is tanking.

Table of Contents

Boeing stock (NYSE: BA) remained sideways in 2023 as most of the price action occurred in a specific price range. However, a recent breakdown has opened doors to a very deep correction. If the travel demand fails to rebound to its pre-lockdown levels in Q4 2023, there is a potential 35% downside from the current levels.

Due to the recent sell-off in the Western equities in general and the US stock in particular, Boeing shares are facing some serious headwinds. Since its yearly peak of $243.2 in September, the stock of the airplane manufacturer has experienced a sharp sell-off.

NYSE: BA Forecast Today

As visible in the chart above, the stock of The Boeing Company has slid below the two most important momentum indicators. These are the 50 EMA and the 200 MA on the 4H charts. It is quite evident that the stock is facing intense selling pressure.

On a 4-hour timeframe, the stock appears to be oversold from the perspective of RSI and MFI. However, there are strong bullish divergences on both indicators, which suggest that the bears are almost exhausted and a relief bounce is on the cards.

Boeing Stock Price History

Boeing is one of the oldest aircraft manufacturers, with a price history going back to 1968. The following chart shows constant growth till 2019 when the lockdown restrictions limited global travelling. Since then, Boeing stock price has been in the midst of a recovery. There seems to be a s strong demand around the $120 level.

Boeing Stock Latest News

In one of the most recent developments in the aviation industry, United Airlines (NASDAQ: UAL) has ordered 50 787-9s aircraft from Boeing. The aircraft will be delivered to the airline operator between 2028 and 2030. The latest agreement also comes with an option for United Airlines to order 50 more Boeing 787s at the end of the decade.

In other Boeing news, the CEO remains optimistic about a rebound in the global travel demand. According to the boss of the jet manufacturer, the travel demand is recovering stronger than expected.

The air travel is yet to recover to its pre-pandemic level, which is affecting the bottom lines of most airline operators as well as manufacturers like Airbus and Boeing. The latest data from IATA reveals that the travel demand in China has recovered significantly, boosting global demand as well.

Why Is Boeing Stock Down Today?

Since the release of its Q2 earnings report, the shares of Boeing have been in a downward spiral. During this time, the stock price corrected 16%. Even though the price surged in the week after the release of second-quarter results, the price action reversed after a rejection from the $243 level.

The Q2 2023 results showed that the company’s defense, space, and security unit reported a loss of $527 million. The revenue of the aviation giant remained at $19.75 billion against the Rifinitive estimate of $18.45 billion. The company also reported a net loss of 82 cents per share against the estimate of 88 cents.

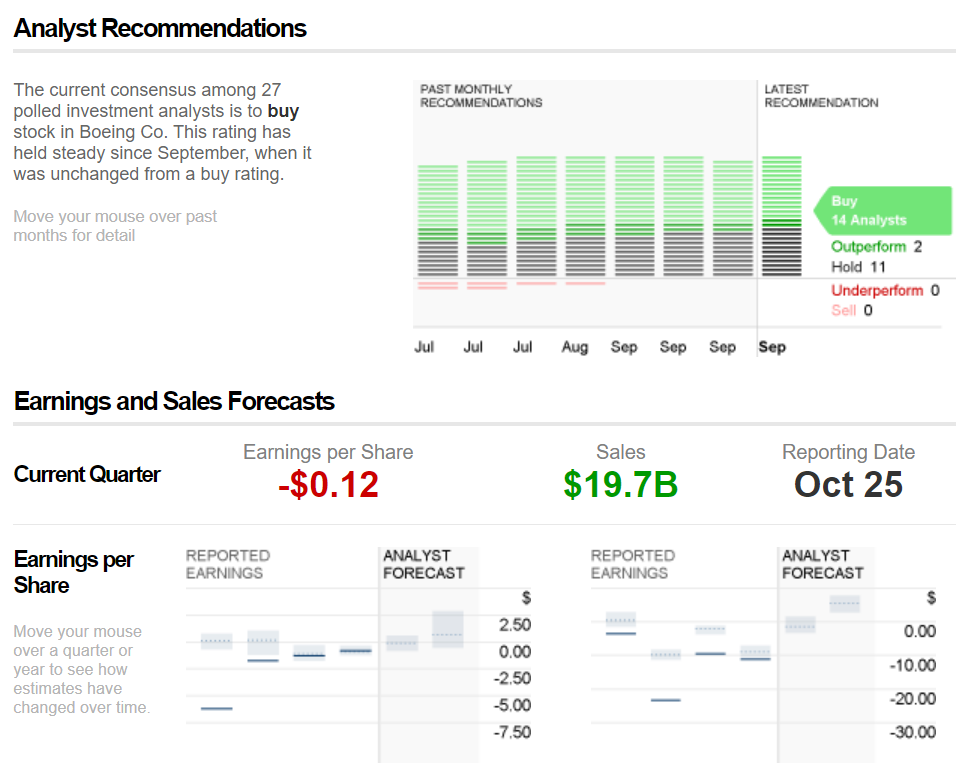

Analysts Remain Bullish On Boeing Shares

According to the 27 analysts that cover NYSE: BA, 14 maintain a ‘buy’ rating on the stock, and 11 have assigned it a ‘hold’ rating. Despite a strong sell-off in the past couple of months, the stock is yet to receive a ‘sell’ rating. The reason behind this positive Boeing stock price forecast by most investment analysts could be expectations of increased travel in the Fall of 2023.

Boeing Stock Price Technical Analysis

The latest analysis of NYSE: BA reveals that the stock has been trading within a very narrow price range since February 2023. However, the price has broken below the range lows since August, and the bears are gaining momentum.

The weekly chart shows 8 consecutive weeks of downtrend without any bounce. The daily RSI depicts an oversold market condition, which suggests that a local bottom might be very close. Based on the technical analysis, Boeing stock price forecast is looking pretty bearish right now. However, as the stock is approaching the 0.5 fib retracement level, there’s a high probability of a bounce from the $182-$185 region.

Boeing Stock Price Forecast 2024

It is quite clear from the above chart that Boeing stock is trading below the 200-day moving average. This is a major sign of weakness in the price of any financial asset. Another concerning thing is the rising strength of the US dollar, which is generating strong headwinds for US equities.

If the S&P 500 index experiences a deeper correction in the coming months, Boeing share price may retest the $120 support level in 2024. An invalidation of this bearish outlook will be a reclaim of the 200 MA on the weekly chart, which currently lies around $200.

In the meantime, I’ll keep sharing updated Boeing forecast and my personal trades on my Twitter, where you are welcome to follow me.