- Despite the upside potential for Bionano Genomics stock, the BNGO stock price forecast sees a drop to 1.84 before a recovery.

The BNGO stock forecast indicates that the potential for improvement in the price activity exists but would probably come after a further dip in the share price of Bionano Genomics Inc. The company is coming off the approval of two patents granted it for its genome analysis technology by the US Patent and Trademark Office.

Patent No 11,291,999 covers all apparatuses and methods the company has developed to use light sources to reduce biopolymer aggregation in nanochannels. Patent No. 11,292,713 expands the company’s existing patents for its optical genome mapping (OGM) technology, developed for DNA imaging and other potential genomic mapping use cases. However, investor reaction to the news was, at best, muted.

The BNGO stock price forecast by institutional analysts sets a 12-month price target of 3.283, which gives the stock an upside potential of 68.35%. However, this upside potential may improve if the stock of Bionano Genomics attains the measured move from the flag’s resolution at the 1.84 price support.

BNGO Stock Price Forecast

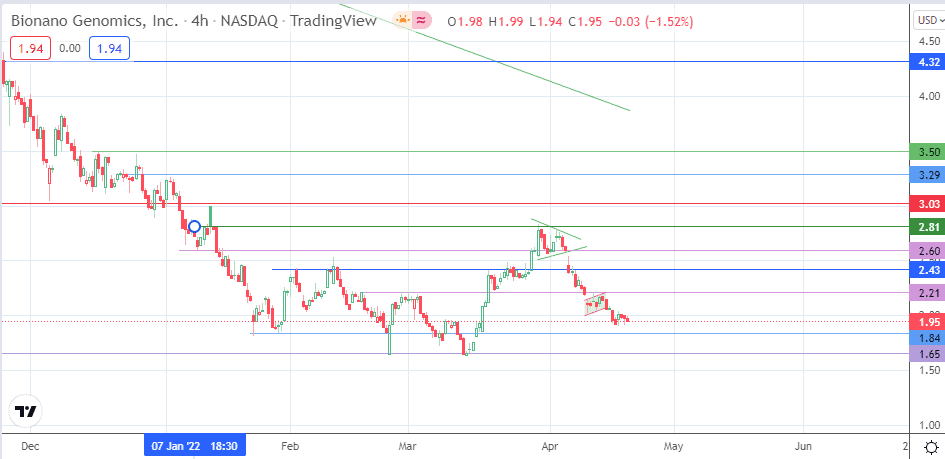

The triangle pattern on the 4-hour chart resolved with a downside break. The move broke below the 2.43 support (2 February and 7 April highs) and took out the 2.21 price support, eventually forming the pole component of the bearish flag pattern. The breakdown move of 18 April completed the flag pattern, setting the tone for a measured move that is expected to hit the 1.84 (23 February and 17 March lows). Extension of this measured move below 1.84 targets the 1.65 price pivot, the site of lows seen previously on 24 February and 14 March).

On the flip side, a price bounce on 1.84 could allow the bulls to retest the 2.21 price mark, now functioning as resistance in role reversal. There is the potential for the price to stall at 2.00 based on psychological resistance plays. If the bulls uncap the 2.21 price mark, 2.43 enters the mix as a role-reversed resistance. Additional barriers to the north are seen at 2.58 (13 January and 29 March highs) and 2.81 (11 January high) before 3.03 enters the mix as another northbound harvest point for bulls.

Bionano Genomics: 4-Hour Chart

Follow Eno on Twitter.