Bitcoin prices took a hit overnight as the cryptocurrency market has been unable to shake off the negative perception around Libra as well as last week’s uncomplimentary remarks from US President Donald Trump. Furthermore, it has emerged that TRON CEO Dustin Sun has rescheduled his lunch date with super-investor Warren Buffett due to medical reasons.

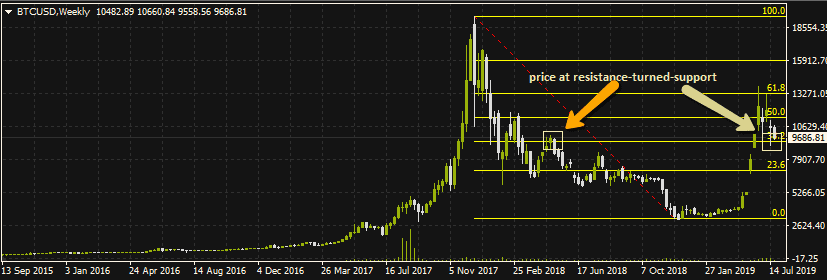

BTCUSD is presently trading at around $9,700 and can be seen to be approaching the key support level on the weekly chart that is formed by the 38.2% Fibonacci level. These Fibonacci levels were derived from a trace from the swing high of November 2017 to the swing low of Dec 9 2018. The 38.2% Fibo retracement price level of $9,350 is also seen to be the previous resistance of April 2018 which was surmounted by this year’s crypto surge.

The 4-hour chart displays the Fibonacci retracement levels and how they act as support and resistance. The $9,350 price level was tested on July 18 and may be tested again if sellers continue to dominate the market.

A violation of this level to the downside will open the door to the $7.057 price level (23.6% Fibonacci retracement). If the $9,350 support area holds firm and BTCUSD bounces at that price area as it did in June and July 2019, then a retest of the $11,600 area (50% Fibonacci price level) is likely to occur in the coming weeks. This is a medium term view and it is expected that there will be several pitstops along the way in the near term.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.