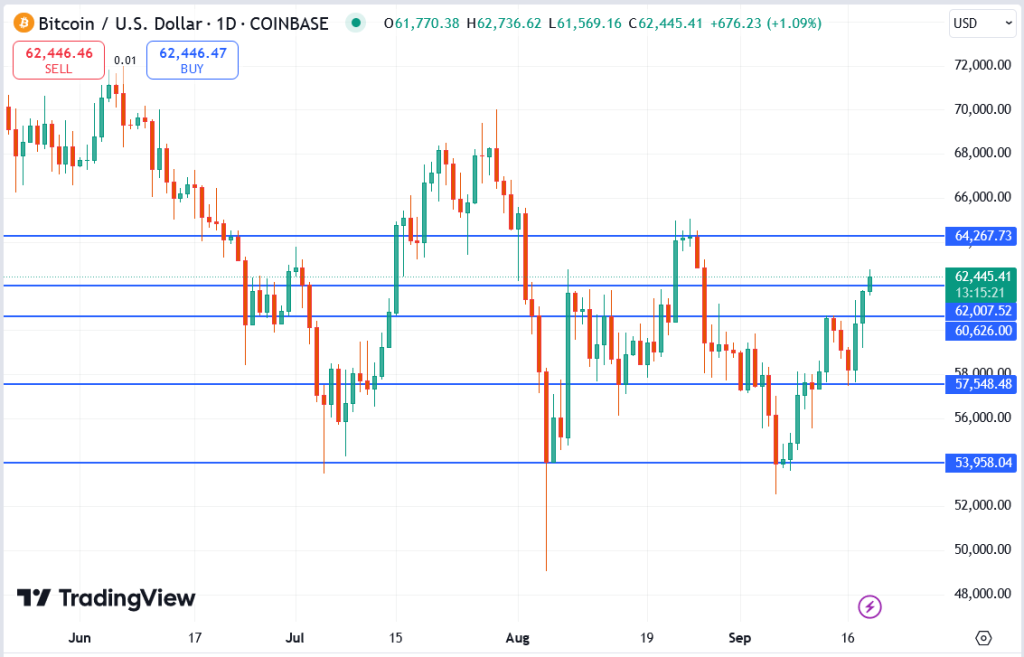

Bitcoin’s price today continues its upward trend, with the current market action reflecting an interesting movement between key support and resistance levels. The daily chart shows Bitcoin trading around $62,445, reflecting a 1.09% rise. This upward momentum highlights a critical technical juncture that traders and investors should carefully analyze.

Bitcoin Resistance Level

Bitcoin is challenging a significant resistance zone at $62,445. A breakout above this level could trigger further bullish action, with the next target being around $64,267, which historically acted as a resistance point in mid-August. Traders should monitor for a confirmed close above this level to confirm further bullish momentum.

Bitcoin support level at $60,626

On the downside, $60,626 provides strong support, which has been tested in previous price drops. This level was last breached in early September, but the quick bounce indicates strong buying interest. If Bitcoin retraces from the current resistance, traders can look for buying opportunities near this zone. Additionally, the support at $57,548 offers an even firmer base, having successfully prevented further declines in July and early September.

The chart hints at a potential reversal in Bitcoin’s downtrend from the July high. However, Bitcoin must maintain its gains and avoid falling below the $60,626 level to confirm this.

An upward break could signal a move towards $70,000 in the medium term. Meanwhile, if Bitcoin fails to break resistance, it may re-visit a consolidation phase between $57,548 and $62,445.

Conclusion

Traders should closely monitor Bitcoin price breakout above the $62,445 resistance or retrace to test lower support levels.