- Summary:

- Drivers of the BTCUSD price in 2022, 2025 and 2030. Learn more if you should buy or sell.

Table of Contents

The Bitcoin price had a difficult start of the year as investors worried about the hawkish Federal Reserve. BTC declined to a low of $40,700, which was the lowest level since September 30th. This price was also about 40% below the all-time high of almost $70,000.

The decline accelerated after the Federal Open Market Committee (FOMC) published minutes of the previous meeting. The minutes revealed that the committee members were getting concerned about inflation. As a result, they are getting comfortable about hiking interest rates as early as in March this year.

The BTC decline coincided with the sell-off of high-growth stocks as investors rotated from growth to value. So, let us look at what to expect in 2021.

Bitcoin Price Chart

BTC and the 50-Week Moving Average

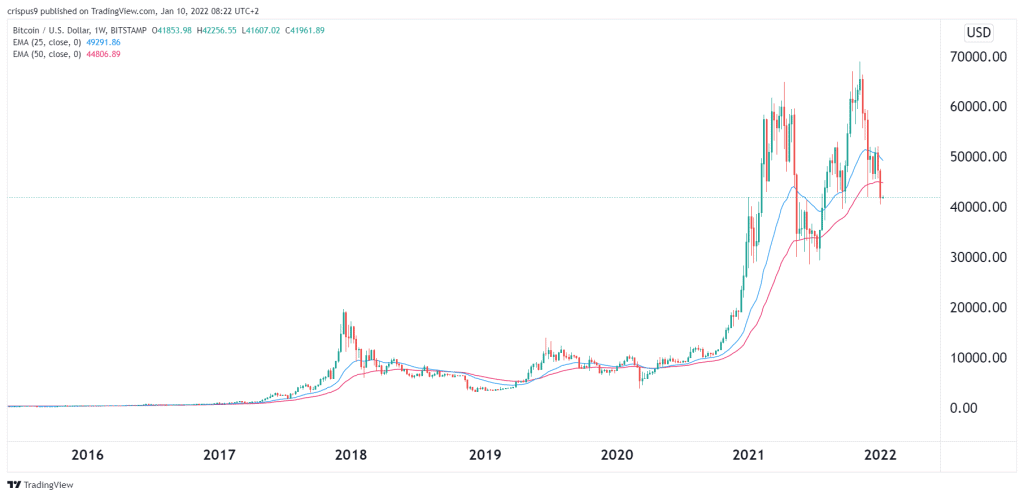

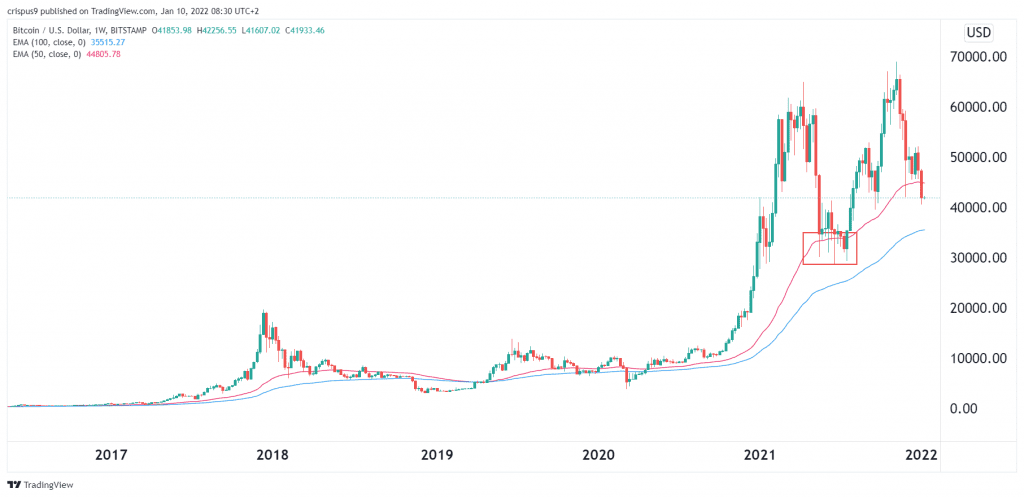

As the Bitcoin price declined, it managed to move below the 50-week exponential moving average. This was a notable development because it rarely happens. The last time that Bitcoin moved below the 50 EMA was in June last year. It then hovered around that level for a while and then resumed the bullish trend. Still, the coin remains above the 100-week moving average.

Asia sells BTC to the West

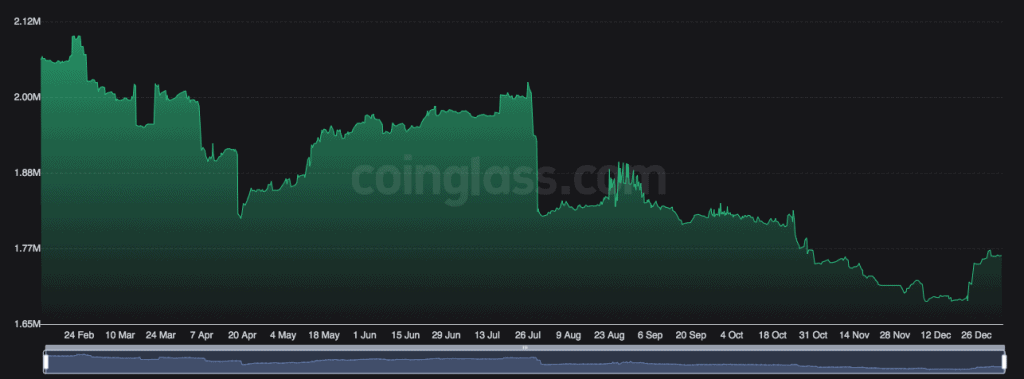

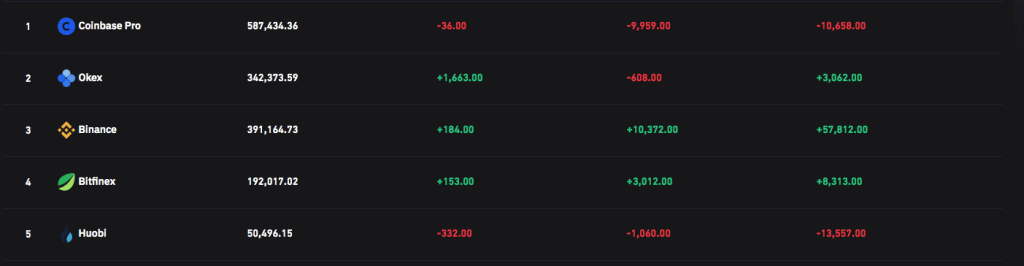

The amount of Bitcoin held on exchanges dwindled from a peak of 2.09 million coins in February, to a 2021 low of 1.69 million in December. However, over 70,000 BTC have been sent to exchanges in the last two weeks, bringing the total to $1.71 million. Furthermore, data from Coinglass shows massive deliveries into Binance of almost 58,000 BTC over the last 30 days. In contrast, at the same time, over 10,000 BTC has left Coinbase.

Aggregate Exchange balances

Exchange Balances +/- (30 Days)

A logical conclusion is that Asian BTC holders have been liquidating holdings. On the other hand, the withdrawals from Coinbase suggests U.S based investors have been net buyers over the last four weeks. This makes sense when you consider the Bitcoin price underperformed during Asian hours in December.

Many analysts attribute the geographic shift to China’s crackdown on cryptocurrencies. Hong Kong-based crypto lender Babel said, “With Huobi completing its China exit last week, the selling pressure from Asia appears to be slowing down”. Furthermore, Bitcoin’s relative stability during the migration from East to West may indicate that US institutions are absorbing the Chinese selling. But is that really the case?

Will Institutions buy Bitcoin in 2022?

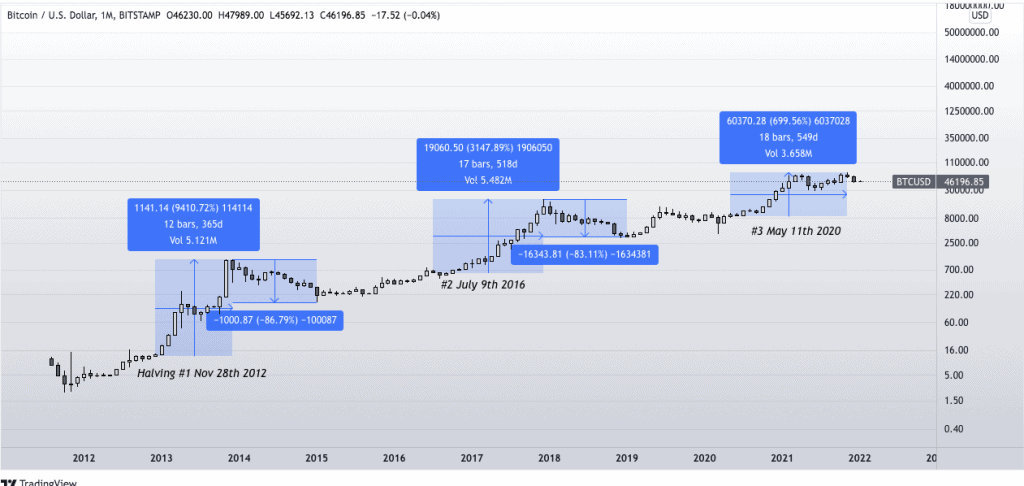

Bitcoin Halving Cycles

A key theme in the Bitcoin environment is that most Bitcoins have already been mined. Data shows that over 18 million BTCs have been mined already. This means that miners have about 3 million more coins to mine since it has a total supply cap of 21 million coins.

In the coming years, the focus will shift to the next halving event that is expected to take place in 2024. Halving is a period when Bitcoin rewards for miners are reduced. Historically, Bitcoin price tends to rise ahead of the halving event.

Therefore, in our Bitcoin price prediction for 2021, halving is not of key concern because it is still so far. Instead, the talk about halving will resume in the market in 2023 and 2024.

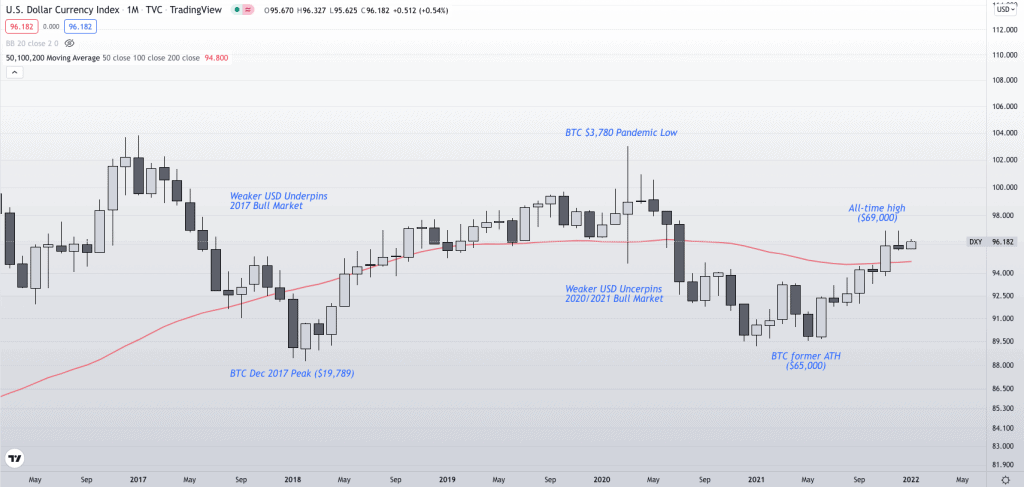

Bitcoin and the US Dollar

Bitcoin and the US dollar have a relationship. For one, Bitcoin was created to address the inefficiencies that existed in fiat currencies like the US dollar and euro. Also, the biggest trading volume of Bitcoin is traded in USDT which are pegged to US dollars.

The US dollar index moved sideways in 2021 as investors focused on the Federal Reserve and the potential for high-interest rates. In the second week of the year, the US dollar index was trading at $95.95, which was about 1% below the highest level in 2021.

In theory, the DXY index should soar as the Fed starts to hike rates while the Bitcoin price should decline. However, the opposite could happen since the Fed tightening situation has already been priced in by investors.

Bitcoin Price Prediction 2022

The Bitcoin price is hovering above $40,000 in the second week of the year. The price has moved below the 200-day and 50-day moving averages. Most importantly, a death cross has happened. A death cross is a situation when the 200-day and 50-day moving averages make a crossover. Oscillators like the Relative Strength Index (RSI) have also turned lower.

Therefore, I suspect that the bearish trend will continue in the first quarter, with the next key target being the July 2021 low of about $30,000. This decline will happen as investors price in a more hawkish Federal Reserve. The situation will then change in the second quarter as investors buy the fact that the Fed has started hiking rates. Still, some analysts believe that the BTC price will rise to about $100,000 in 2022. They include the co-founder of Nexo and analysts at JP Morgan.

Bitcoin Price Prediction 2025

Predicting where the Bitcoin price will be in 2025 is a bit difficult. In my view, I suspect that the price will be significantly higher than where it is because of three main reasons. First, there will be regulatory clarity by 2025, which means that many institutional investors will be able to invest in it well.

Second, while the Fed is expected to start hiking interest rates in 2022, history shows that exiting the current policies will be a gradual process. Besides, hiking too fast will lead to shocks in the American economy, which has almost $30 trillion in debt.

Third, going by history, Bitcoin has been in a strong bullish trend over the years. Although it is a volatile asset, the coin will likely continue rising over the years. A study by Long Forecast expects that Bitcoin price will soar to $72,000 in January 2022 and then end the year at around $38,000.

Bitcoin Price Prediction 2030

The Bitcoin price prediction for 2030 is equally challenging because the year is about 8 years ahead. Historically, such long-term predictions are difficult because of the unknowns that could happen. For example, a decade ago, no one was able to predict the Covid-19 pandemic.

Still, Bitcoin lovers believe that the coin will keep rising in the next decade as the amount of supplies decline and as more institutions shift to the coin. On the other side, critics believe that the coin will keep falling since its utility value has been discredited.

Therefore, in my view, I belong in the former camp that expects Bitcoin to do well by 2030. I expect that it will rise above $100,000 in that period.

Conclusion

Bitcoin has been a great success in the past decade. It has managed to move from less than $1 to becoming a $1 trillion juggernaut. The past performance has been helped by low-interest rates and strong demand by retail investors.

The next phase will be driven by institutional investors as the regulatory environment in the United States and other Western countries continue. In 2022, I expect that the coin will decline in the first quarter and then rebound later on. By 2025 and 2030, the BTC price will be substantially higher than where it is today as it goes mainstream.