- Summary:

- The Beyond Meat share price is set to close out a huge week of gains, after it registered 5 consecutive winning days on Thursday.

The Beyond Meat share price is sharply higher and is up by 9.40%, as sentiment in food company stocks soared this Friday. The improved sentiment in the Beyond Meat share price comes after the breakup of Kellogg Company and recent upgrades by analysts.

The Beyond Meat share price is riding a wave that has seen the stock register five consecutive days of price gains. The stock closed 6.03% yesterday and is now up 23.77% this week alone. The recent uptick means that the stock has hit the median target, giving the stock some room to navigate toward the high price mark.

Institutional analysts had set the 12-month Beyond Meat share price target at $30.30. This is the median price, with the price targets at the two extremes set at $62 and $21. The stock is aiming to post recovery after hitting lows at 20.00 on 9 May. These lows came as the company’s Q1 2022 earnings floundered, coming in below expectations. However, the company saw a rise in its revenue, which was a positive sign.

Since then, the stock has registered a 50% increase. The company also plans to introduce new offerings, with a vegan steak scheduled for launch in late 2022. The company has also secured a deal with Disneyland to offer a meatless option for all its meals. This deal comes from Disneyland Paris’s plan to increase its plant-based food offering.

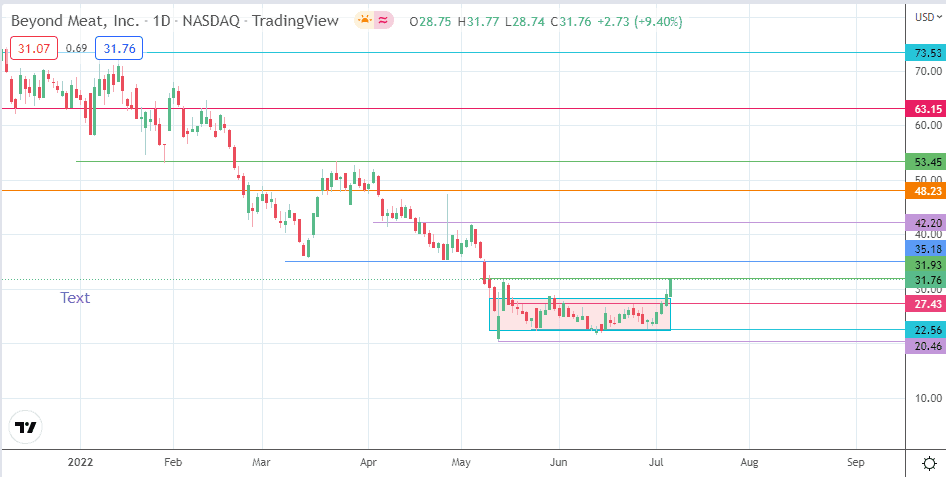

Beyond Meat Share Price Outlook

The intraday uptick is challenging resistance at the 31.93 resistance level (13 May high). A break of this price mark clears the way toward the 35.18 barrier where the prior high of 9 May 2022 is found. Above this level, additional barriers to the north are found at 42.20 (20 April and 4 May 2022 high) and 48.23 (1 March 2022 high).

On the flip side, rejection and a decline toward the 27.43 resistance will set up a retest of that pivot. A breakdown of this level gives the bears access to the 22.56 support. Below this level, the 20.46 support (12 May 2022) comes into the mix as an additional target to the south.

Beyond Meat: Daily Chart