- Summary:

- The Beyond Meat share price's advance has stalled at a key resistance. Can Kim Kardashian's new ad campaign save the stock?

The Beyond Meat share price is up 0.73% on the day, adding to Thursday’s 13.25% jump. The 2-day winning streak follows the news of celebrity Kim Kardashian being made the face of the company’s new ad campaigns. The maker of plant-based meat alternatives announced that the reality TV star would be promoting some of the company’s product lines using the brand’s newsletter and other content channels.

This attempt at a recovery from the floundering stock follows the release of dismal Q1 earnings figures, which were “well below” expectations. The company had reported a Q1 loss of $1.58 per share despite increasing its revenue from $108.2 million to $109.5 million. Analysts expected a loss per share of $0.97 and $111.6 million in revenue. This led to a further drop in the Beyond Meat share price when the stock was already struggling.

Given the headwinds that investment firm Oppenheimer has identified, it remains to be seen how far the Beyond Meat share price recovery will go. Oppenheimer had said after the earnings results that the company was facing increasing competitive pressures and was having problems scaling its business. As a result, Oppenheimer advised investors to stay on the sidelines. A median Beyond Meat share price target of $21.50, as shared by institutional analysts on CNN Money, indicate downside potential on the stock from current levels.

Beyond Meat Share Price Outlook

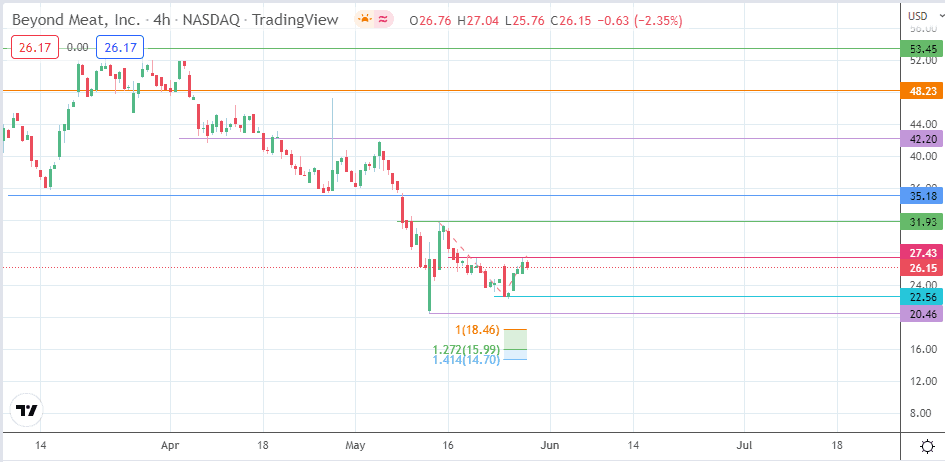

The price action now challenges the resistance at 27.43 (18 May high). The pathway towards the 31.93 resistance (13 May high) will be clear if this barrier gives way. Additional upside targets are found at the 35.18 price barrier (9 May high) and the 42.20 price mark, where the 19 April 2022 and 4 May 2022 highs are located.

On the flip side, the bears’ stout defence of the 27.43 resistance will result in a pullback move that targets support at 22.56 (24 May low). Failure of bullish protection of this support level opens the door for a further descent towards 20.46. Below this level, new record lows beckon, targeting potential Fibonacci extension levels at 18.46 (100% extension) or 15.99 (127.2% extension) if the descent is more extensive.

Beyond Meat: 4-hour Chart