- Summary:

- The Base Resources share price went parabolic on Monday after the company published strong results. BSE shares spiked by over 12%

The Base Resources share price went parabolic on Monday after the company published strong results. BSE shares spiked by over 12% and soared to the highest point since April 2017. It has rallied by more than 1,300% from its lowest point in 2016, meaning that it has outperformed the FTSE 250 and FTSE 100 indices. It has a market cap of almost 400 million pounds.

Base Resources earnings

Base Resources is a fast-growing mining company that has operations in Kenya, Australia, Madagascar, and Tanzania. The company focuses on mineral sands, which contain vast titanium minerals. These products are used widely in industries like paint, paper, and plastics. They are also used to make toothpaste, sun cream, and ceramics. As a result, these products have seen significant demand in the past few years.

Base Resources share price soared after the company published strong annual results. Its total revenue rose to $279 million as prices of its products rose by 33%. As a result, its EBITDA rose to $158 million while its net income jumped to over $80 million. The firm had a free cash flow of $59.6 million and a net cash position of $55.4 million. As a result, the firm announced that it will distribute over A$35.3 million in dividends.

The BSE share price also rose aftert the company boosted its forward guidance for the year. It now expects that it will produce 74,349 tons of rutile, 325,148 tons of ilmenite, and 13,280 tons of low-grade rutile and zircon products. It also expects to extend the mine life at its Kwale operations. The CEO said:

“We have completed another operationally strong year and, with the continued improvement in mineral sands prices throughout the period, we were able to achieve record financial outcomes. This, and our disciplined management of costs, has enabled the continuation of robust returns to shareholders.”

Base Resources share price forecast

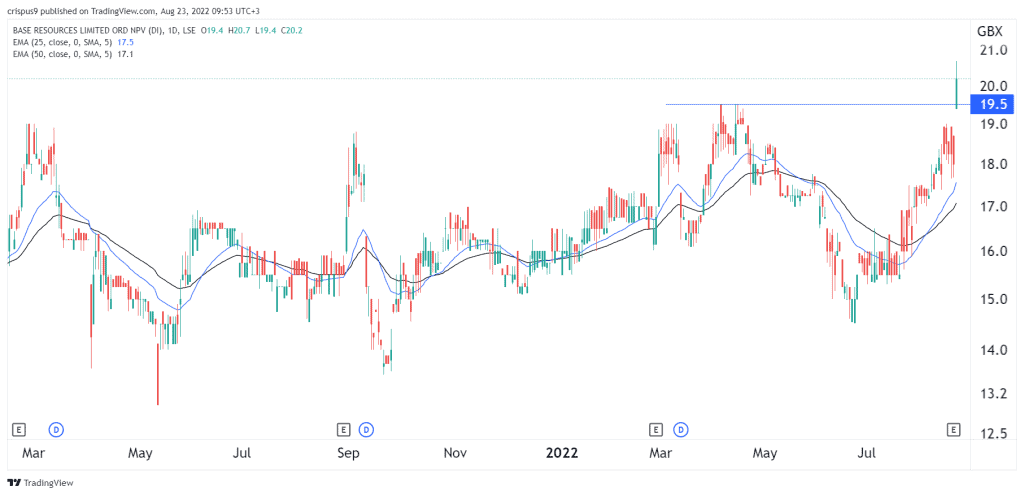

The daily chart shows that the BSE stock price has been in a strong bullish trend in the past few weeks. The rally accelerated on Monday after the company published strong results. As it rose, it managed to move above the important resistance at 19.5p, which was the highest point on April 4. It also rose above the 25-day and 50-day moving averages.

Therefore, the stock will likely continue rising as the company’s business continues to boom. If this happens, the next key resistance level to watch will be at 25p. A drop below the support at 18.5p will invalidate the bullish view.