- Summary:

- Barclays share price (LON: BARC) is tumbling as the investors are not impressed by the company's 2022 financial results.

Barclays (LON: BARC) share price has revealed its Q4 financial results, and the investors are not happy. Although the top British Bank’s annual profits beat the expectations of GBP 4.95 billion but still fell short on YoY basis. In 2022, the company’s net profit remained at 5.02 billion pounds which was a 19% decrease from 6.2 billion in 2021.

In the recently released financial statement, the Barclays saw a 26% increase in its operating costs. The decline in investment bank’s profits was surprising for many analysts who were expecting an increase in profitability amid high-interest rates. However, the bank’s quarterly financials came out totally different.

Why Is Barclays Stock Tumbling?

The latest financial report also revealed that the Q4 attributed profit of 1.04 billion pounds also beat expectations. However, it was also a 4% decline from the same quarter a year ago. The pre-tax profit was also noted to be short of consensus expectations of GBP 1.5 billion.

Barclays shares reacted negatively to the news as the price fell by 10% immediately. However, the price showed some recovery on Thursday and Friday. LON: BARC is now trading at 174.48p which is 7% below its last week’s closing. There was also a decrease in the ROE, which remained at 10.2% compared to 14.4% in the previous year. Apart from regulatory fines, a decrease in dealmaking fees was also the reason behind these results.

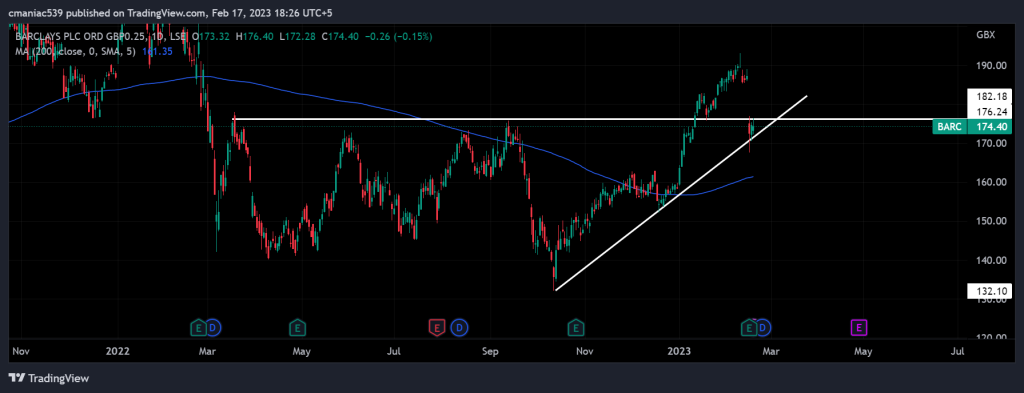

Barclays Share Price Forecast – 1D Chart

Technical analysis of Barclays share price shows that the 176p level has become a strong resistance. Although LON:BARC price broke above this level in January 2023, but failed to gain any strength above this level. Consequently, the price is retesting the upwards trendline as investors await the FOMC minutes.

A breakdown below the upwards trendline would give bears a lot of momentum. In such an event, the 200-day moving average that lies at 161p might provide some support. The bulls need to reclaim 176p level very soon, or they might be in for a wild ride. Considering the recent developments and the CPI data, the bearish scenario has more probability of playing out.