- Summary:

- The Barclays share price is up for the third session in a row, after the stock continued to attract investor interest check my technical analysis today

The Barclays share price is up for the third session in a row, after the stock continued to attract investor interest, days after passing US bank stress tests. The acquisition of a big-name mortgage lender has also helped to keep sentiment on the bullish end of the equation.

Barclays Bank’s US Intermediate Holding Company (IHC) underwent a Federal Reserves Board stress test on 23 June. The IHC’s assessment of the results indicates that the bank’s capital ratios remained above regulatory minimums across all nine quarters tested. In other words, the banks US branch passed the stress tests, pushing the stock up by 3.15% on 24 June.

The Barclays share price also saw demand from its acquisition of British mortgage lender Kensington in a $2.8 billion deal. Kensington posted strong earnings numbers in its result for the year that ended 31 March 2022. The deal was announced on Friday and is to be completed anytime beween Q4 2022 and Q1 2023.

The recent uptick seen in the Barclays share price, which has seen it rise from 140.80 on 7 April to present levels above 160p, comes on the back of tailwinds provided by the Bank of England’s interest rate hikes, as UK inflation hits 4-decade highs.

Barclays Share Price Forecast

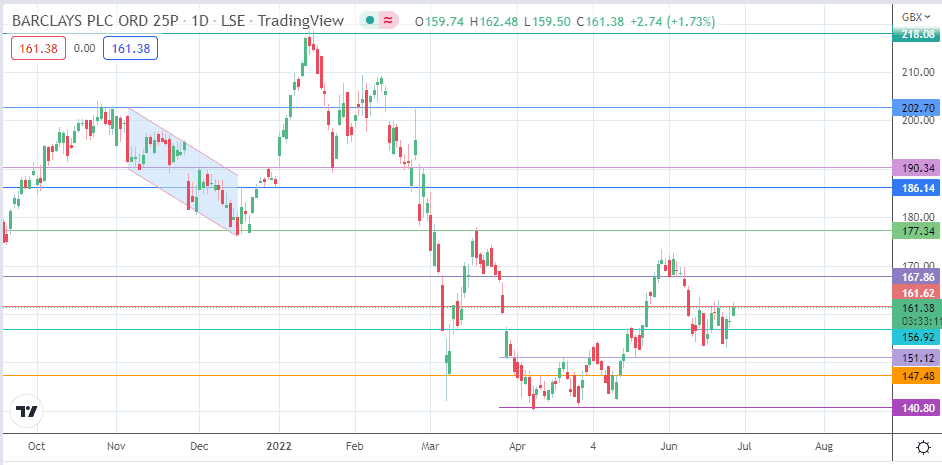

The daily chart shows an evolving rounded bottom pattern, with the neckline at the 161.62 resistance mark (9 March and 21 June highs). The bulls must break this neckline to complete the pattern, targeting a completion move at the 173.60 resistance level (23 March and 30 May highs).

This move must clear the resistance at 167.86, where the 4 March high and 1 June low are seen. Additional targets to the north come in at the 177.34 price mark (17 March high), and at 186.14, where the previous lows of 24 December and 31 December 2021 are located.

Conversely, a rejection at the 161.62 resistance forces a pullback to 156.92 (20 June 2021 low). A breakdown of this level invalidates the pattern and opens the door toward the 151.12 support level. If these 29 March and 19 May 2022 lows are broken, additional targets to the south emerge at the 147.48 support level and at 140.80 (7 April 2022 low).

Barclays: Daily Price