- Summary:

- The Barclays share price is up as investors expect the Bank of England (BoE) to hike interest rates for the 4th time in a row.

The Barclays share price opened Thursday’s trading session with a bullish gap. However, some gap covering activity by the bears has left the stock hanging on to a portion of its opening gains as it trades 0.94% higher as of writing.

The Barclays share price is benefiting from the expectation of a further rate hike by the Bank of England (BoE) later in the day. If the BoE delivers on the expected 25bps rate hike, this will follow the footsteps of the Fed, which made an aggressive 50bps upward adjustment to the Federal Funds Rate on Wednesday evening.

The Barclays share price is attempting to push towards levels last seen in late March after a slew of negative price triggers hit the stock in April. Firstly, the bank saw a fall in its Q1 2022 profits by 18% after litigation expenses and conduct charges put a dent in its profits. It had to suspend market-making activities after a clerical error in its US trading division caused a trading loss on structured debt products.

The bank plans to buy back $1.25 billion worth of its shares, but this will only happen after it has cleared things with US regulators over the trading loss. The BoE decision is expected to dictate the flow of price action on the stock in the short term.

Barclays Share Price Outlook

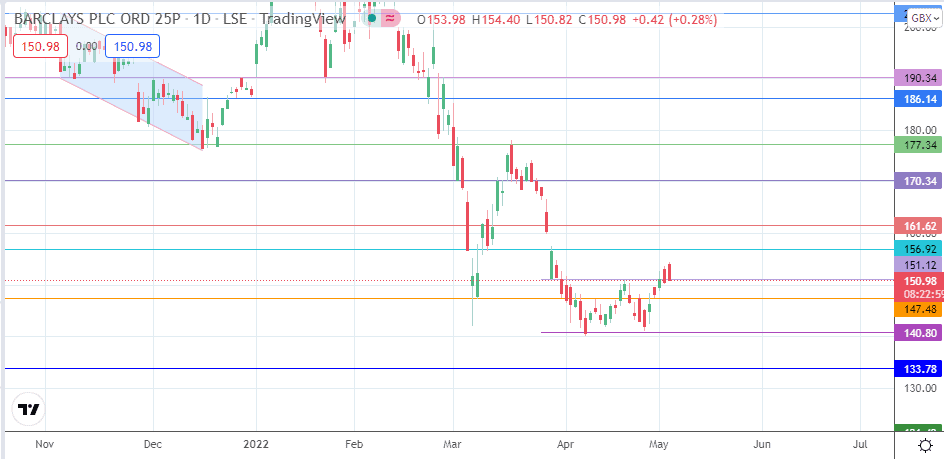

The double bottom on the daily chart has been completed following the break above the neckline at 151.2 (29 March low and 21 April high). The active daily candle is in the middle of a return move towards the broken neckline. The expectation is for the neckline to reject this return move, paving the way for a bounce that targets 156.92 initially (10 March low, 29 March high). The measured move has the 161.62 resistance mark (9 March high) as its completion point, and this is the next target if the bulls push beyond 156.92. Additional targets to the north are found at 170.34 (14/24 March highs) and 177.34 (17 March high).

On the flip side, a breakdown of the former neckline by the return move truncates the measured move from the pattern and opens the door for a further decline towards 147.48 (8 March and 29 April lows). The site of the 7 April/27 April troughs that constitute the double bottom is at the 140.80 support. Below this level, further price deterioration leads to a drop that finds support at 133.78 (1 December 2020 and 29 January 2021 lows).

Barclays: Daily Chart

Follow Eno on Twitter.