- Summary:

- The Barclays share price is set to face a strict test on Thursday as the bank releases its next earnings report.

The advance in the Barclays share price will face a strict test when the bank releases its Q3 earnings report. The UK banks are about to enter the earnings season with significant tailwinds from the recent speculation of a potential Bank of England (BoE) rate hike in December.

Credit Suisse’s analysts gave the bank an improved outlook earlier in the month, saying that the downward trend in bad debt provisions, and earlier-than-expected share buybacks that have matched cost clarity, have boosted sentiment on the stock.

Barclays’ earnings are due on Thursday, 21 October.

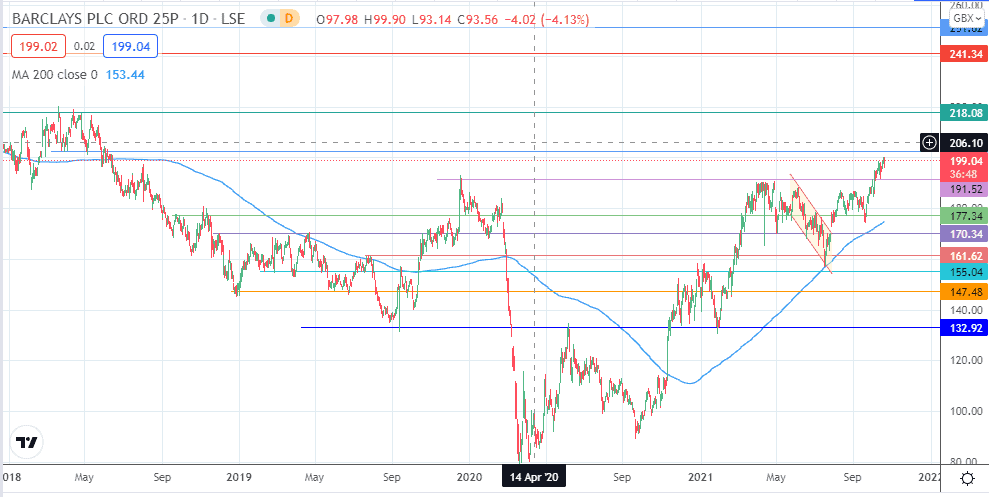

Barclays Share Price Outlook

The current price advance looks set to target the 202.70 resistance. If the bulls uncap this area, 218.08 (20 March 2018/26 April 2018 highs) comes into the picture as an additional upside target.

On the flip side, rejection at 202.70 could allow for a correction which brings in 191.52 as the next downside target. If the corrective decline continues, 177.34 and 170.34 will enter the picture as an additional downside target.

Barclays: Daily Price

Follow Eno on Twitter.