- Summary:

- The Barclays share price recovery has stalled as traders wait for the upcoming interest rate decision by the Bank of England

The Barclays share price recovery has stalled as traders wait for the upcoming interest rate decision by the Bank of England and the Fed. It has also stalled as investors watch the stalled investment banking trends. The BARC shares are trading at 168.56p, which is slightly below this month’s high of 173p. However, it remains about 20% above the lowest level in May.

Barclays is a leading bank that has operations in countries like the UK and the US. It operates both a retail-focused bank and an investment banking one. Therefore, the bank is having a mixed year. However, with interest rates rising, its interest income has jumped. In the first quarter, interest income rose by 26% to 2.34 billion pounds as the BOE started hiking rates. But higher rates also lead to recession or stagflation risks, which will hurt the bank’s performance.

At the same time, investment banking is in trouble, with the number of deals stalling. For example, there have been a handful of major IPOs this year while the number of companies merging has crashed. Therefore, there is a likelihood that the bank’s key divisions will underperform in the second quarter.

The only major division that could offset the weakness in consumer and investment banking is its Fixed Income Commodities and Currencies (FICC) division. In Q1, this division’s revenue jumped by 26%. Still, Barclays is a good bank because of its diversification. The next key catalyst for Barclays will be next week’s Fed and BOE decisions. The two banks are expected to hike interest rates in a bid to lower inflation.

Barclays share price forecast

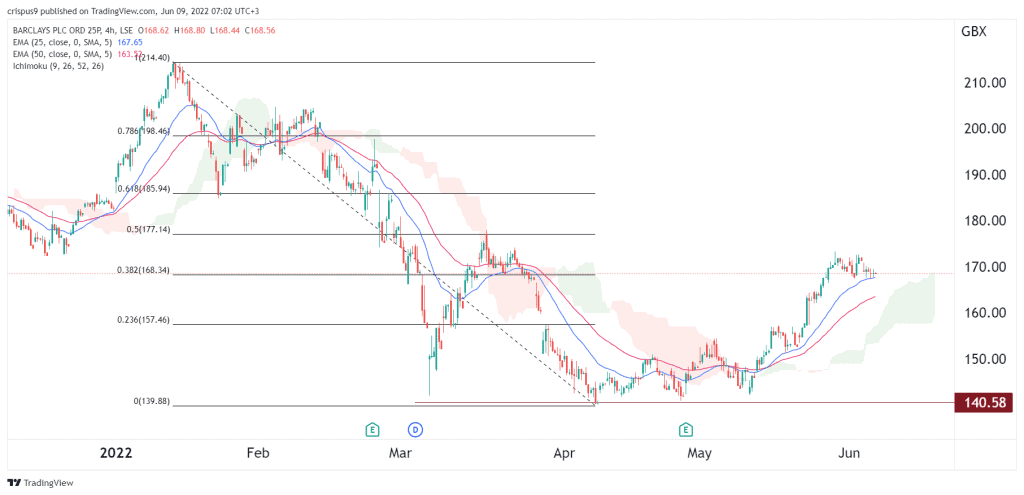

The four-hour chart shows that the BARC share price bullish recovery has stalled recently. It is trading at 168.56p, which is slightly below the highest point last week. This price is also along with the 38.2% Fibonacci retracement level. It has also moved above the 25-day and 50-day moving averages and the Ichimoku Cloud.

Therefore, there is a likelihood that the Barclays share price will continue rising as bulls target the next key resistance at 180p. A drop below 160p will invalidate the bullish view.