- Summary:

- What is the outlook of the Barclays share price? We explain whether you should buy or sell the stock at the current prices.

Global banking groups had a challenging period in the first quarter as investment banking slowed and the crisis in Ukraine complicated things. As a result, Barclays share price has dropped by over 30% from its highest point this year. Other banking stocks like Lloyds, NatWest, and HSBC have also struggled recently.

Barclays has underperformed other UK banks like Lloyds and NatWest because of its exposure to investment banking. According to WSJ, the number and size of deals announced in Q1 declined by more than 30% from the same period in 2021. As a result, top deal-makers like Goldman Sachs, JP Morgan, and Morgan Stanley reported a sharp drop in this revenue. Barclays has lagged because it has exposure to this sector.

The BARC share price will react to the upcoming quarterly results scheduled for the 28th of this month. Analysts expect that the firm’s business slowed down in Q1. For example, they predict that its revenue was over 5.7 billion pounds in Q1 while its earnings per share was 0.01. Moreover, like other banks, its profitability is expected to drop on a YoY basis because last year’s Q1 benefited from the previous year’s provisions.

Still, Barclays is a good bank in the long term because of its diversified business performance. In periods of weak investment bank performance, other divisions like consumer and business banking offset its business.

Barclays share price forecast

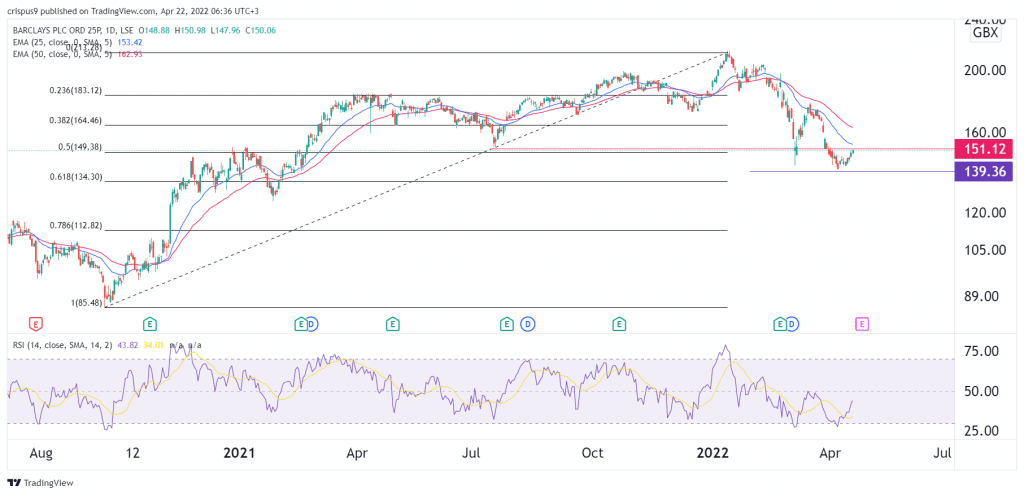

The daily chart shows that the BARC share price has underperformed in the past few days. It has managed to move slightly above the 50% Fibonacci retracement level. The stock has moved below the 50-day and 25-day moving averages while the Relative Strength Index (RSI) is pointing upwards. It is also along with the lowest level on July 19th 2021.

The recent uptick does not seem convincing. Therefore, there is a likelihood that the stock will dip ahead or after the upcoming earnings. If this happens, the next key support to watch will be at 135p. A move above 150p will invalidate this bearish view.