- Summary:

- The barclays share price has moved sideways in the past few weeks. We explain why this happened and why it could rise by 20%.

The Barclays share price is in a tight range even after the relatively strong UK economic numbers. The stock is trading at 195p, where it has been in the past few days.

UK economic data

Barclays is a major banking institution that has a strong market share in the UK where its BarclayCard is one of the most popular credit cards in the country. Therefore, in most cases, Barclay’s does well when the UK economy is doing well.

And recent data suggests that the economy is powering on well. For example, data published by the government on Tuesday showed that the country’s unemployment rate continued its downward trend. It fell to a pandemic-era low of 4.4%.

And on Wednesday, numbers by the Office of National Statistics (ONS) revealed that the country’s inflation jumped to the highest level in a decade. The headline CPI rose to 4.2% while core CPI rose 3.4%. This performance was mostly because of the surging oil prices.

These numbers are important for UK banks like Lloyds, NatWest, and Barclays because they signal that the BOE will adopt a more aggressive monetary policy. This could mean exiting the quantitative easing program and hiking interest rates. The Barclays share price does well when interest rates are relatively high.

Meanwhile, analysts are bullish on the BARC share price. The median estimate for the stock is 236p, according to data by MarketBeat. This price is about 20% above the current level. Some of the most bullish analysts are from Shore Capital and Morgan Stanley.

Barclays share price forecast

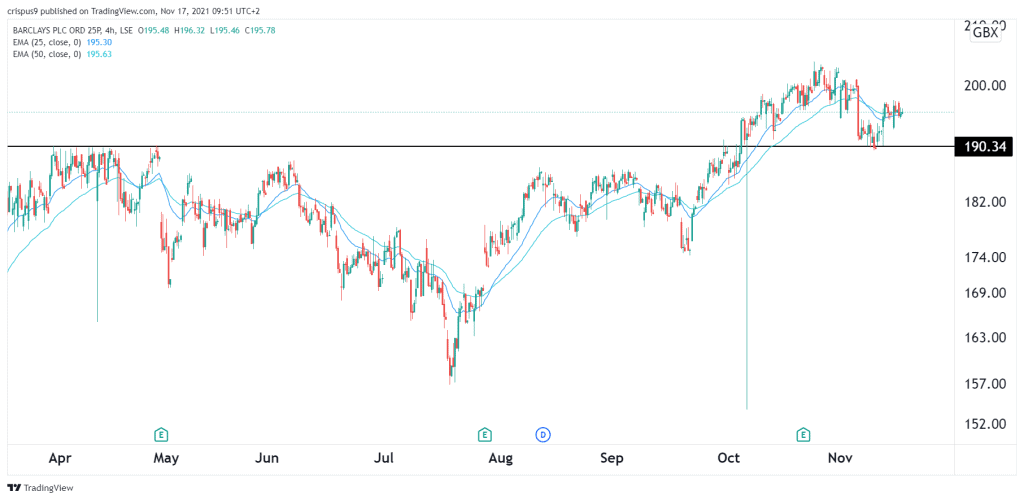

On the four-hour chart, we see that the BARC stock price has formed a break and retest pattern. This is a popular pattern that happens when an asset retests a key support and resistance levels. The stock did that when it retested the support at 190p. This was the highest point in April this year. The shares are still above the 25-day and 50-day moving averages.

Therefore, the outlook of the stock is bullish, with the next key resistance being at 205p, which was the highest level this year. This view will be invalidated if it drops below 190p.