- Summary:

- The Barclays share price has endured its largest single-day drop in four months as the recent pay rise for 35,000 workers worries investors.

The Barclays share price fell steeply on Tuesday after the bank awarded a cost-of-living pay rise to 35,000 staff within the United kingdom. The hefty 5.05% drop in the Barclays share price has erased gains made in the last two days, as rising inflation in the UK now brings to light the plight of companies facing the prospect of additional wage bills.

As UK inflation inches towards the 10% mark, labour unions are headed for a face-off with their employers. Worker unrest and the threat of industrial action are already being seen in the communications and aviation sectors.

The pay increase will kick off on 1 August, after the Unite workers union and the bank’s executives came to an agreement on the staggered pay increase. The pay hike will also feature additional pension contributions and enhanced overtime payments.

The pay rise may be a welcome relief to the junior and mid-cadre workers in the Barclays Group. Still, it has got its investors worrying about the cost implications to the bank’s revenues and profit expectations. As a result, the Barclays share price drop is the largest single-day drop since 4 March 2022.

Barclays Share Price Forecast

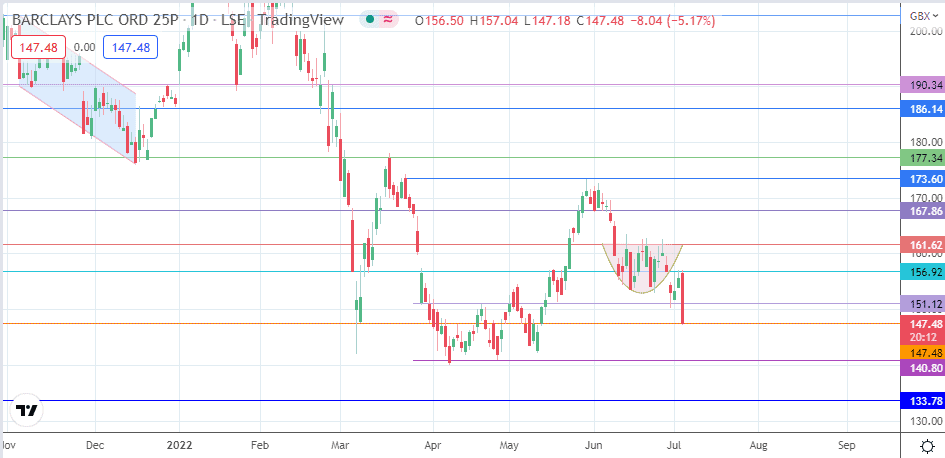

The intraday decline is testing support at the 147.48 price mark (7 March and 13 May low). A breakdown of this price mark targets the 140.80 pivot, marked by the previous lows of 7 April/27 April 2022. Below this level, additional support is seen at 133.78 () and 126.12, site of the previous high of 18 June 2020. Finally, the 130.00 price mark forms a potential pitstop, as it houses the prior lows of 6 March 2020 and 28 January 2021.

On the other hand, a bounce on the 147.48 support allows the bulls to retest the 151.12 price mark, the site of the previous neckline of the triple bottom pattern. A further uptick targets the 156.92 resistance (4 July 2022 high), leaving 161.62 as another target to the north if the bulls breach this resistance. Finally, the 167.86 and 173.60 resistance levels round off potential upside targets, but these are presently not viable.

Barclays: Daily Chart