- Summary:

- Barclays share price had a relatively difficult period in November. It managed to decline from the monthly high of 200p to a low of 180p

The Barclays share price had a relatively difficult period in November this year. The stock managed to decline from the monthly high of 200p to a low of 180p. It is now trading at 190p, which is a few points above the lowest level in November.

November was an eventful month for Barclays as the company’s board ousted the then CEO, Jes Staley, for his relations with Jeffrey Epstein. The bank elevated C.S Venkatakrishnan to be the new CEO. Staley was awarded an exit package worth about 2.4 million pounds, which some investors protested.

Recent results showed that Barclays’ business is doing relatively well. Its results published in October showed that its group income jumped to more than 16.5 billion pounds in the third quarter. Its cost to income ratio was relatively steady at about 64% while its profit before tax rose to more than 6.9 billion pounds. It also has a relatively healthy CET Tier 1 ratio.

December will be a relatively calm month for Barclays and other London banks like Lloyds and Natwest. There will be no major corporate presentation and the company will publish its results in January. Therefore, investors will continue looking at macro trends like inflation, retail sales, and the Omicron variant.

Barclays share price forecast

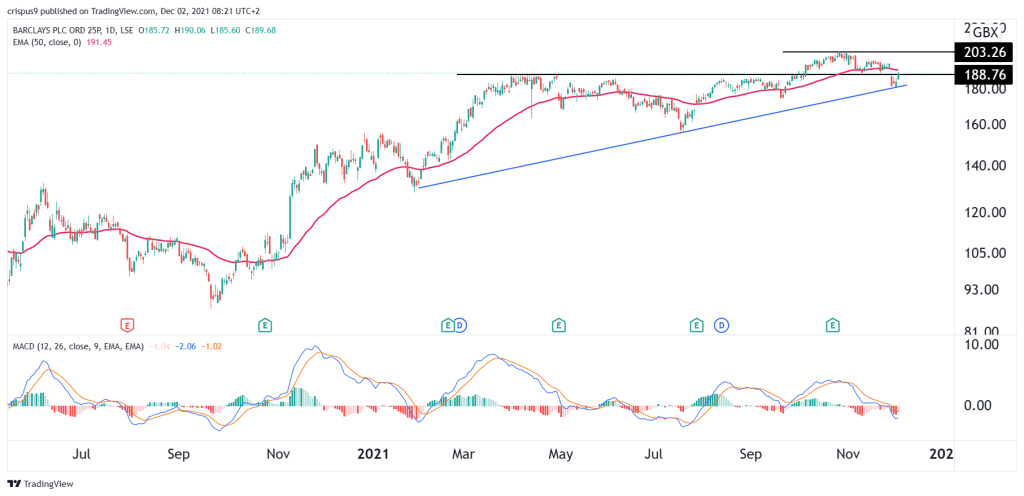

The daily chart shows that the BARC share price has been in an overall bullish trend in the past few months. Recently, however, this bullish momentum has started waning. It has moved to the 50-day moving average. The current price is the highest it has been since April while the MACD indicator has moved below the neutral level.

Therefore, at this time, the outlook of the Barclays share price is neutral with a bullish bias. The bullish case will be confirmed if it manages to move above the key resistance at 200p. This view will be invalidated if the stock moves below 180p.