- Barclays share price has held steady near its highest level since June 2018 as investors reflected on the transition from an easy-money policy

The Barclays share price has held steady near its highest level since June 2018 as investors reflected on the transition from an easy-money monetary policy. The BARC stock is trading at 200p, which is about 152% above the lowest level last year.

Tightening monetary policy

Barclays and other banks like Lloyds and HSBC will be in the spotlight as investors wait for the upcoming Bank of England (BOE) interest rate decision. The bank is expected to signal that the era of easy money is about to end.

Although it will not hike interest rates today, it will likely start tapering its asset purchases. Tapering will be followed by rate hikes possibly in the coming few months. The decision will come less than 24 hours after the Federal Reserve delivered a relatively hawkish statement that was in line with Wall Street expectations.

Banks tend to suffer in a period of low-interest rates because they tend to depress their profit margins. However, a bank like Barclays has benefited because low-interest rates have led to higher stock volatility, which has helped its trading business. At the same time, low rates have led to more deal-making, which has helped its investment banking division.

Still, a transition from low rates to higher rates will have a positive impact on the company because of its mortgage and credit card business. However, there is no guarantee that the transition will lead to a better Barclays share price since the transition has already been priced in.

Barclays share price forecast

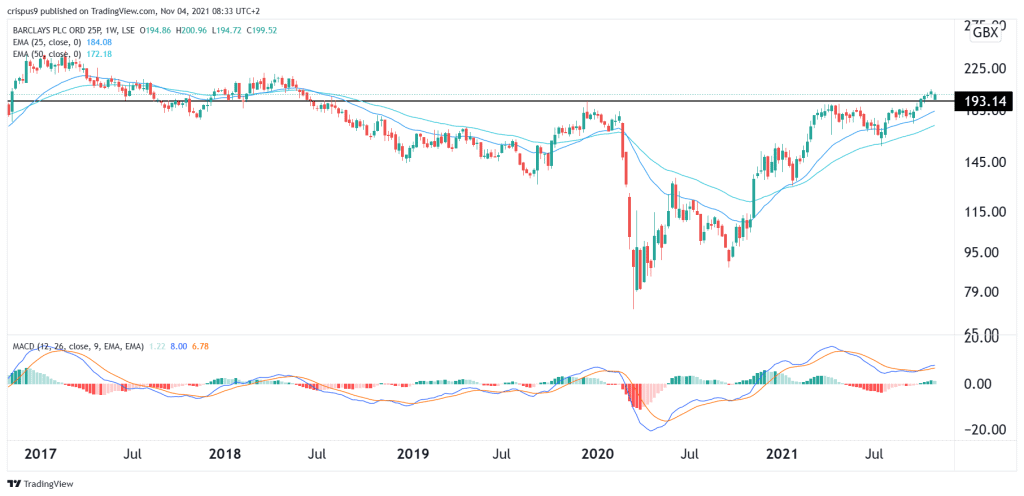

Turning to the weekly chart, we see that the BARC share price has been in a strong bullish trend in the past few weeks. Recently, the stock managed to move above the key resistance level at 193p, which was the highest level in April this year and December 2019. The stock has also formed an inverted head and shoulders pattern and moved above the 25-week moving average.

Therefore, in the longer term, the Barclays share price will likely maintain a bullish trend. This will likely see it rise to the key resistance at 250p.