- Summary:

- The Barclays share price pulled back even after the company reported strong quarterly results. The BARC stock declined by about 0.70%

The Barclays share price pulled back even after the company reported strong quarterly results. The BARC stock declined by about 0.70% on Thursday and are trading at 196p.

Barclays earnings

Barclays joined its Wall Street lenders to report a sharp increase in profits as the global economy recovers. The company said that it earned about $2 billion in net income in the three months that ended in September. This was a sharp increase since the firm’s profit in the same period in 2020 was about 611 million pounds.

This growth was mostly due to the company’s investment bank division where profits rose by 85% to 1.16 billion pounds. In the UK, its profit rose to more than 317 million pounds. This was because the company removed some of the funds in its reserves.

Barclays is not the only one in reporting strong results. Last week, most banks like JP Morgan, Goldman Sachs, and Morgan Stanley reported strong results, helped by the investment banking division.

The Barclays share price has also risen by 35% this year as investors reflect on monetary policy. Interest rates in its key markets like the UK are expected to rise as they address the rising inflation.

Barclays share price forecast

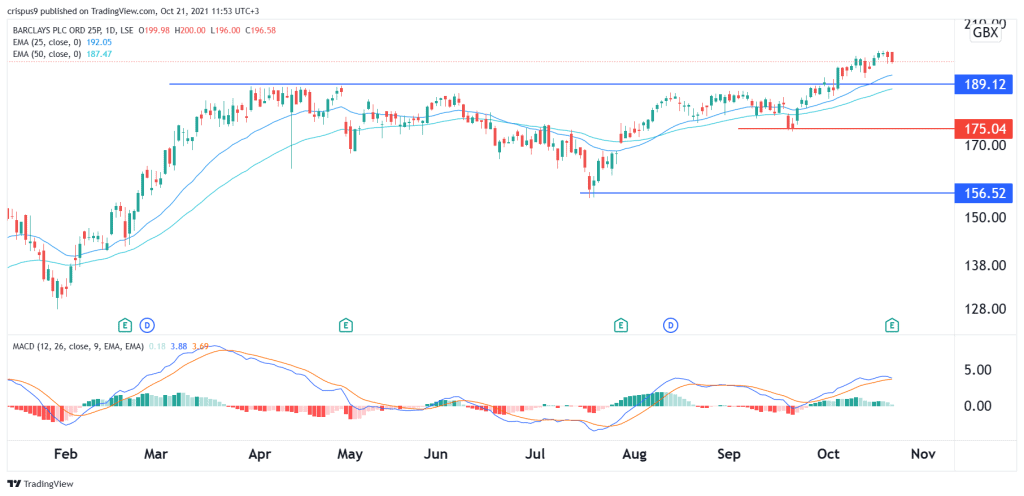

In my recent article, I predicted that the stock would rise to 200p. The daily chart shows that the BARC share price has been in a strong bullish trend in the past few months. Recently, the stock managed to move above the key resistance level at 190p, which was the highest level in April. The shares remain above the 25-day and 50-day moving averages.

Now, the stock seems like it is doing a break and retest pattern. This is a situation where the stock moves and retests the important support or resistance level it just passed.

Therefore, there is a likelihood that the stock will retest the support at 190p and then resume the bullish trend. If this happens, the stock will resume the bullish trend and attempt to test the important resistance at 250p. On the flip side, a move below 175p will invalidate the bullish view.