- The Royal Mail share price could see limited upside to the tune of 13.1%, according to analysts at Barclays Bank.

The positive trigger for the stock comes from the slightly bullish outlook provided by Barclays Bank for the stock. Analysts at Barclays have set a 12-month price target of 400p for the Royal Mail share price. This indicates the potential for a 13.1% upside compared with the current market price.

However, gains in the Royal Mail share price could be limited by headwinds associated with worker absences from COVID-19 infections and the proposed strike action of postal workers ahead of the UK municipal elections. Plans to fire and recall 1,000 managers are also stirring up plans for another industrial action from the UK-listed Royal Mail, the mail delivery component of the UK postal service system. Talks are scheduled over the weekend between the Royal Mail CEO Simon Thompson and union leaders.

Members of the Communication Workers Union (CWU) had walked out of work earlier in the week after feeling “insulted” by the offer of a 2% wage increase following a wage freeze in 2021-2022. The CWU says the recent spike in UK inflation makes the recommendation of a 2% increase over two years “nothing short of insulting”.

Royal Mail Share Price Outlook

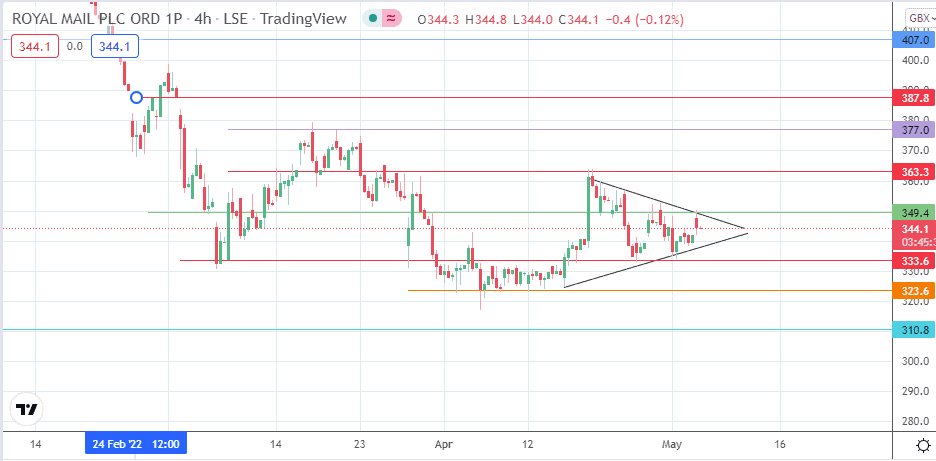

The intraday rejection at the 349.4 resistance has led to a decline which pursues a move towards the triangle’s lower border, just above the 333.6 support level. A breakdown of this border opens the door for the bears to push towards the 323.6 support level. Below this level, the 21 December 2020 low at 310.8 forms an additional target to the south.

On the flip side, a break above the triangle’s upper border and the 349.4 resistance level (31 March and 5 May highs) allows for an advance that targets the 363.3 resistance barrier (28 March and 21 April 2022 highs). A further advance targets 377.0 (21 March high) before 387.8 (25 February high) comes into the picture as an additional target to the north.

RMG: Daily Chart

Follow Eno on Twitter.