- Summary:

- Bank of America (BofA) has reported Q2 2019 earnings of $0.74 per share, beating market estimates of $0.70 per share &exceeding the Q2 2018 figure by 17%.

Bank of America (BofA) has reported better than expected 2019 2nd quarter earnings of 74 cents per share, as against 70 cents per share the market was expecting. This figure also trumped the Q2 2018 figures by 17%. The strong earnings came on the back of a solid performance in its conventional banking portfolio, consisting of increased loan growth and interest rates, as well as diversification and expansion of its consumer banking services. However, earnings from investment banking activities continued to remain weak, and the performance of its FICC division was also underwhelming.

BofA Technical Setup

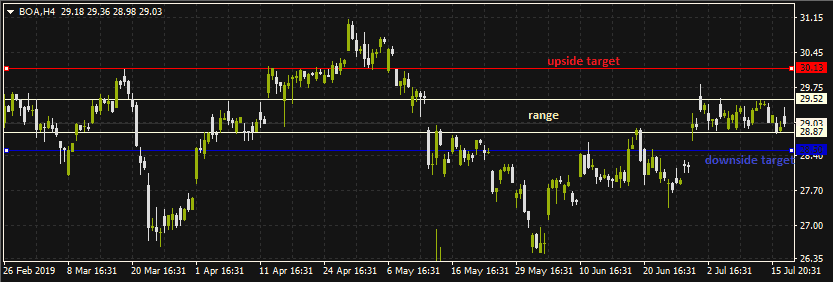

After opening with an upside gap of 20 cents, the stock has started to retreat towards the floor price of the range identified in the chart below. This brief selloff may be as a result of concerns about the impact of future rate cuts on the bank’s revenue base, seeing that its investment division is not performing well and a lot of its profit comes from interest earned on loans.

A break below the support of 28.87 may open the door for Bank of America’s stock to drop to the next support level of 28.45. The stock would need to break the 29.52 resistance area to attain a target of 30.13, the resistance seen in March and April 2019.

Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.