- Summary:

- Higher defense spending from the UK and Europe will be a key factor that pushes the BAE Systems share price higher.

The BAE Systems share price is down 1.26% on the day, which puts the stock in danger of recording a seventh straight losing session.

However, the stock could soon reverse fortunes as it has significant tailwinds. The recent declines are more of a correction resulting from profit-taking. Moreover, the selling volumes are thinning out, which provides hope of a bullish takeover of price action.

What powers this optimism behind the BAE Systems share price? First, the Russia-Ukraine war appears to have awoken the UK and the EU to the dangers that lie directly outside their borders. This has led to a slew of negotiations on NATO membership, new pacts (the UK and Finland just signed a defence treaty) and the need to modernize their military arsenals.

On the back of this scenario, BAE Systems and Rolls Royce have secured a $2.5billion contract to build next-generation deterrent nuclear submarines for the UK. This is part of an entire 10-billion-pound defence contract package codenamed “Dreadnought”.

Last week, BAE Systems Chief Executive Charles Woodburn said he saw medium-term opportunities from increased defence spending in Europe and other markets. This statement came as the company posted guidance that it said was on track to meet its 2022 growth outlook for sales and earnings. The company expects to see a 2-4% boost in its FY2022 sales and 6% growth in its underlying earnings per share and EBITDA.

BAE Systems Share Price Outlook

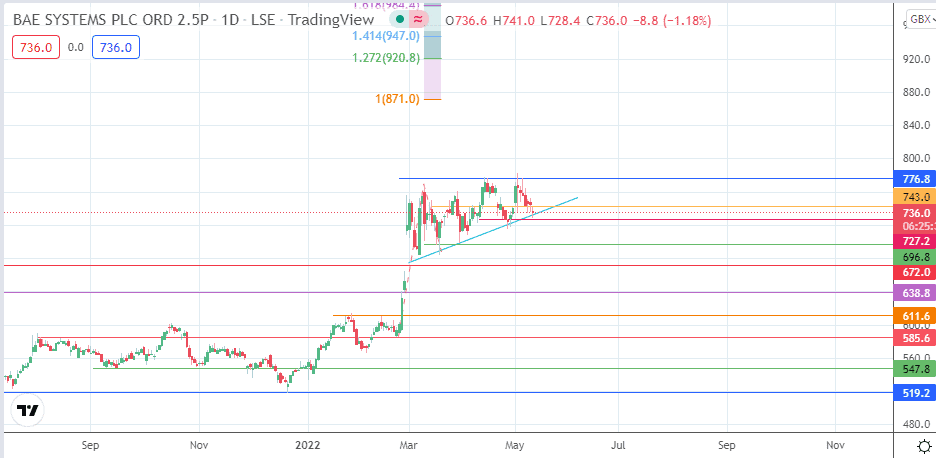

The evolving ascending triangle on the daily chart puts the BAE Systems share price on course to burst to new all-time highs. This move should come from a bounce on the current support, formed by the previous low of 7/26 April 2022 and the triangle’s lower border. To break the triangle, this bounce must take out the 743.0 price mark and the 13 April/6 May highs at 776.8.

The measured move from the triangle’s breakout should attain completion at the 100% Fibonacci extension level at 871.0. A further extension of this move targets 920.8 (127.2% Fibonacci extension level), with a chance of 947.0 (141.4% Fibonacci extension) serving as a harvest point for the bulls in the future.

On the other hand, a breakdown of the support at 727.2 allows for a decline that targets 696.8 (4/29 March lows). This move invalidates the triangle. If the 696.8 support level breaks down, a further correction towards 672.0 (21 February 2020 high) and 638.8 (24 February high in role reversal) could be on the cards. However, the sentiment on the stock is bullish in the medium-term, so any dips could provide buying opportunities.

BAE Systems: Daily Chart