- Summary:

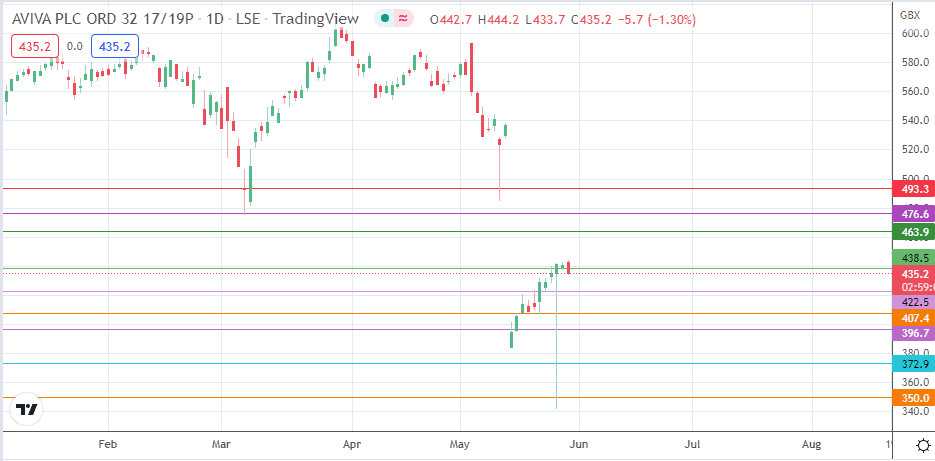

- The Aviva share price needs to break the resistance at 438.5 to resume the recovery from the recent slump.

The Aviva share price is down 1.16%, even as the controversy surrounding the alleged sexist remarks made at CEO Amanda Blanc refuses to die down. CEO Amanda Blanc admitted she was caught off guard by the remark when she told an Irish Times reporter that no one “prepared for comments like that” in an AGM.

Nevertheless, the furore of allegedly sexist comments on social media set the tone for a steep drop in the Aviva share price in mid-May. The stock has pared some of those losses but continues to struggle after its Q1 earnings were deemed weaker than expected by none other than Deutsche Bank.

Deutsche Bank’s analysts have a pessimistic view of the insurer’s performance in 2022 as evidence of what the bank calls a “tougher economic climate, and worse weather” are expected to pile pressure on the stock. UBS and Jeffries were more neutral in their outlook.

Technically speaking, the price action continues to dither around the 438.5 support level, with the day’s downtick threatening to truncate the breakout move. So what are the possible scenarios facing the Aviva share price?

Aviva Share Price Outlook

If the active daily candle achieves a penetration close below the 438.5 price mark, it invalidates the breakout move temporarily, forming a bearish engulfing candle. As a result, a bearish outside day candle is required to make the pullback to 422.5 (24 May 2022 low) possible. Below this level, 407.4 (23 May 2022 low) and 396.7 (17 May 2022 low) are additional southbound targets.

On the flip side, confirmation of the break of the 438.5 price level using time/price filters opens the door for a potential push to the 6 January 2021 high at 463.9. Additional price targets to the north are seen at 476.6 (26 February and 7 March lows), while the 493.3 price level represents a further northbound target represented by previous lows at 20 July 2021 and 30 November 2021.

Aviva: Daily Chart