- Aviva (LON: AV) share price is rebounding after an intense sell-off. In the coming days, price can retest the 428p level.

Aviva (LON: AV) share price has dropped by more than 14% in the last 14 days. The negative price action also coincides with the growing banking concerns in the west that have jolted the industry. UK equities, in general, and the bank shares in particular, are having the worst month of the year together with their US counterparts.

On Monday, Aviva shares opened below 400p for the first time since October 2022. The price even dropped to 383.5p during the first hour of trading but recovered back above the daily opening immediately.

Aviva Share LSE Drops To 5-month Lows

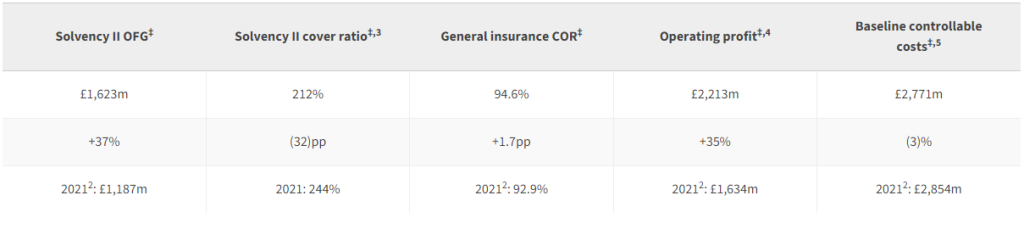

The ongoing negative LON: AV price action is quite surprising, as just recently, the company’s earnings beat market expectations by 93.5%. The latest financial report also disclosed that the Gross Written Premiums (GWP) increased in both Canadian and UK markets. However, an increased COR in both markets was a major concern for the investors.

A major reason behind the tanking Aviva share price is the prevailing uncertainty regarding the fate of Credit Suisse. According to the most recent news, the swiss lender is being acquired by its rival UBS after a government-brokered deal of SFR 3 billion. The move is expected to give markets some confidence amid a global financial emergency.

Aviva Share Price Can Rebound Strongly

In light of the recent financial results and the technical analysis of its chart, Aviva shares appear to be a good buy right now. There are multiple reasons for this outlook. Firstly, the price has retested the range lows of 383p. Secondly, the company has just recently announced a share buyback of £300 million. Thirdly, the financial situation and the profitability of the company remain strong.

Considering all the above factors, our Aviva share forecast for the near term remains at 428p. The retest of this level will be very crucial for future price action. This level comes from the confluence of the range mid and the 200-day moving average.